The first “patient facing” digital health wave is over….

Or the customer segment that can’t be ignored any more

With no doubt, the last quarter has brought some reckoning into the digital health world, with an approx. $200 Billion (!) drop in publicly traded digital health companies’ market caps from the Q1 21’ pick. Not that other tech industries aren’t suffering from negative public sentiment, but in this case I would actually claim that we have yet to reach the bottom. Even more so, I think that for some companies their current valuations would be a faint dream in months to come.

Harnessing Garner’s hype cycle, I would suggest the following graph for virtual first provider (or virtual pay-viders) -

Just to have all bases covered, a “virtual-first provider” is any company that tries to affect patients/develop new or better care delivery model by utilizing virtual touch points. B2C, B2C2B, B2B2C, or anything else that has the “C” component.

Haven’t we already met?

How many virtual first providers are out there? I saw numbers ranging from hundreds to thousands.

(Also worth keeping in mind another number - ~350,000 digital health apps currently available…)

In any case, just think how many companies you’ve met or heard about that can be described by the following statement:

“We provide the best of breed experience for patients coping with ________ (diabetes / pain / depression…) by seamless/efficiently connecting them with ______ (professional team of / physician / therapists / similar people) and utilize technology/AI/secret sauce to improve quality of care and reduce costs…”

There are so many that you already see a whole category of tech stack companies selling to V1P (great posts from A16Z and Greycroft covering some of the action).

According to Rock Health, in 2021 alone more than $12Bn were invested in private V1P companies.

Now, all these companies face the challenges of selling their products at scale (speed and volume) AND showing at least some path to profitability (as Michael Greeley shares in his great blog). I would argue there are substantial challenges on both ends.

Generating revenue growth

Over the last 12-18 months a significant amount of companies have succeeded in raising large amounts of capital despite having relatively limited revenues. Their revenue trajectories (the famous hockey stick chart) were challenging even in the optimistic intra-COVID environment. Now they need to overcome a couple of hurdles:

Virtual venue/the telemedicine option (“virtual first”) does not seem to be a differentiator by itself, nor a standalone business as I’ve tried to argue in detail in a separate post. Also see this recent post (funny and helpful as always) from Nikhil Krishnan.

And many other components of the companies’ tech stack are actually off-the-shelf and thus also not a differentiator (build vs. buy dilemma, again great sources by A16Z and Greycroft).

“Superb user experience” is a common answer to what differentiates a company. Now, although UI/UX is (perhaps) a great way to onboard patients, payers or providers are reluctant to pay for it. For example consider the CCM or RPM codes that reflects volume of usage (16 days per month, 40-min of physician time, etc.)

The only way to tap into the quality bucket is via value-based/risk-sharing models which are still relatively scarce and very hard to achieve.

Even onboarding new patients is a much harder task these days, given so many companies are trying to pull into the same patient population and the changing privacy regulation from Apple, Google and even Facebook/Meta (more on that below).

Those who choose the B2C path to monetization will find out that despite the macro trends suggesting that on average there are more cash-paying customers, in real life most people still don’t want to pay (what they feel like is additional) cash for healthcare.

It isn’t rosy for B2B2C as well. Buyers’ fatigue has become a real problem, driven by the sheer number of companies per each category and the frequent limited scope / disease focus they have (how many applications can one person have on their phone?)

Playing the ‘AI/ML card’ isn’t helping as well, as the slow adoption of AI in healthcare might suggest.

To summarize, many sellers with limited moat are currently trying to tap into a much smaller number of buyers (a great summary of last Vive and HIMSS from one attendant – “there were only sellers but nobody who wants to buy”), which already started to command lower pricing points and much slower revenue growth.

Companies competing for new revenues these days:

And even if a company succeeds in tackling these challenges and creating an appealing revenue performance, it faces the question of “revenues at what cost?”

Gross and operational margins are still a thing

As showing a path to profitability is becoming a key element, or at least having a company endure without needing to raise increasing amounts of capital every year or so, expenses and operational efficiency are back on stage – which is bad news for many companies.

First and foremost, not so long ego, revenue growth were the #1, 2 and 3 top goals (at the expense of almost everything else, as the #1, 2 and 3 top questions investors asked companies in the last two years comes down to what their current and projected ARR were). Combined with almost unlimited amounts of capital, companies were designed and optimized in this modus operandi – the kind which is very hard to switch. Now the need to change this structure comes in a very bad timing in terms of the market:

There is simply not enough talent out there (both senior and junior, per the large amount of active companies vs. well, the general shortage of talent) – which creates a two-fold effect – companies need to pay more for less capable/experienced employees. Both mean higher expenditures (upfront overhead cost and longer learning curves/lower performance).

With talent, there is also the discrete problem of healthcare specialists. No matter if a company needs physicians, nurses, therapists or pharmacists, there is a growing shortage of all of them. Consider that in the US there are ~1M physicians and ~70% are employed by hospitals or health systems (a number which is only expected to grow). It doesn’t matter if you try to directly employ them or use outsource vendors (like Wheel, SteadyMD, Openloop), this is still a supply-demand problem that hinders scale up and drives higher costs.

Not just is talent becoming more expensive and harder to reach, but so are customers. As mentioned above, even targeting and identifying relevant customers is more challenging these days (for example for B2C customer acquisition, new privacy regulations limit targeted marketing, which essentially means your marketing is much less focused/efficient and more expensive) and it is also now clear that people are not rushing to leave the in-person venue.

Which leads to the (costly) issue of managing the transition of patients between virtual care and in-person services. In other words, it is clear that having only a virtual option is not enough. Companies can either build (Thirty Medison’s NYC hair transplant clinic), acquire physical assets (Babylon) or partner (Hims and Hers/Carbon). Each has its costs and challenges.

A more complex user (patient and physician) journey means more customer support functions are needed than ever. In these cases, customer support means more overhead and services on top of the software component which equates to… more expenditures and lower margins.

Bottom line (or price) and thoughts on the next wave

Scarcity of (overwhelmed) buyers that need to choose from a much larger pool of vendors is a textbook scenario for price reductions, consolidation and a long tail of companies that will become zombie-companies or will perish.

I do think that besides consolidation (either as the consolidator or the consolidated), digital health companies that affect patients (i.e. that have a “C” somewhere in their business model – both existing companies and those yet to emerge) have a couple of other things worth considering.

Create a real moat (i.e. not just a superior user experience). As I’ve shared in different places, I think digital health is first and foremost a business execution question rather than technology. BUT technology can be the topping on the cake and serve as a differentiator. By technology I do not mean hand waving of AI/ML/… but genuine know-how (technology + domain expertise) that is translated to a product functions others objectively do not have.

Generate real clinical (and cost reduction) evidence. This is actually meaningful form of a moat in healthcare. When there are many similar options out there you need data to speak for you. Real and robust data (double-blind, RCT kind of data) can do wonders in healthcare as long is the evidence is substantial/unquestionable (i.e. showing “non-inferior” results to pass the FDA threshold might be good enough to have regulatory clearance but won’t go a long way with clinical buyers). For example, see the prescription digital therapeutics case.

Build a truly scalable operational model. By scalable I mean both speed and size. Reduce any dependency on a scarce resource (specific talent for example) or a specific type of buyer (especially with notoriously long sales cycle) as much as possible and make sure that if you increase the sales volume, the margins indeed improve.

One example for a company pursuing these points - moat, real world evidence and scalable model - might be Laguna Health (note - Arkin portfolio).

Laguna started as a tech enabled solution to help patients recover (faster) after hospitalizations and avoid preventable readmission. The team decided to invest in generating clinical and financial evidence from the get-go, demonstrating high engagement and significant savings in a randomized clinical trial (thousands of dollars per patient).

Overtime they recognized that the technology platform they built and the clinical models (know-how) they codified into the platform are providing significant value also when they are provided as a standalone solution (i.e. no care management/operational piece provided by Laguna) and is actually more attractive to a large group of customers. One additional benefit for these buyers, on-top of the ROI demonstrated by Laguna is a cost-effective solution for their talent supply constraints.

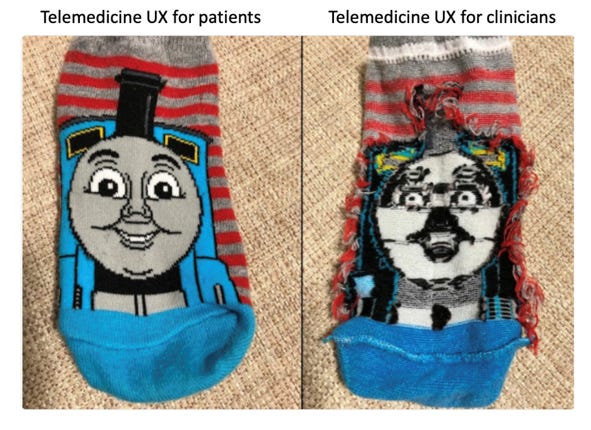

Finally, companies need to address the healthcare specialists as a customer and a stakeholder, even if they are not their (perceived) users. Putting it differently, aim to have their genuine buy-in. The kind that makes someone be your advocate. Nikhil Krishnan’s telemedicine piece and this brilliant meme really illustrates part of the problem in terms of the user experience:

Very few companies generate real acceptance from physicians and nurses. To be fair, it is an extremely hard-to-reach goal, per the level of burnout and perception of digital health by providers. A recent Stat piece articulates this issue nicely:

“…Sachin Jain, a physician and health care executive, has described this phenomenon as “the innovation bubble.” There is the “change layer,” in which visionary ideas about health care transformation flourish, but there is also the “reality layer,” in which most care is actually delivered. Unfortunately, few digital health apps are in the reality layer…”

This is crucial not only for companies that directly interact with providers (and thus need them to use the product to justify the price tag), but essentially almost for any company, as patients still rely most on their physician’s opinion as a source for information (sorry, Google).

A great example is GoodRx.

GoodRx’s core product do not interact directly with physicians in any way. It is a pure DTC play – “compare (drug) prices, find FREE coupons, and save up to 80%”. But one of GoodRx’s strong growth engines is actually having physicians recommending their patients to use GoodRx! (see this interview with Doug Hirsch, Good Rx founder and CEO). The reason they do it is because they simply understand that there is a better chance their patients will actually dispense the medications and thus adhere to their treatment regimen by using GoodRx…

For sure there are more ideas and we would love to hear them and help if we can. It seems that 2022 will be a pivotal year for digital health, and a great time to build (or to sharpen) digital health companies.

As always big thanks to Sam Cronin from our team for his help!

Nadav

Subscribe to easily receive new posts!

Let us know what you think!