Where is the telehealth market heading and how can the history of the EHR industry help predict it?

In the last couple of weeks there has been on a lot of chatter on the gloomy situation of telehealth companies. Teladoc’s stock is down >70% from its peak in Jan 21 from $287 to <$75 and AmWell has had a ~90% (!) drop from $42.8 to <$4.5 (as of Feb 8th). Pieces like “The telehealth bubble has burst” from FastCompany were published to provide some explanations, as only a year ago telehealth seemed like the coolest kid in the block.

During the first couple of months of COVID, when the world was much more a virtual than a physical place, it seemed like we were at the beginning of a new era that would favor telehealth companies. In Dec 2020, at the very peak of these positive outlooks, I tried to take a stab at this topic and argued why the current vintage of telehealth was not actually as attractive as it seemed and the x20 multiples on revenues the market was giving them were not sustainable.

I’m far from being happy these predictions currently hold, especially because these companies are led by visionaries that imagined virtual medicine almost 20 years ago (Teladoc was founded in 2002, AmWell in 2006), building and scaling their businesses despite tremendous obstacles.

Sadly, I think this unfavorable trend will only continue and expand into any company that focuses its business model on merely enabling virtual encounters. Needless to say, this is a very bold statement so hope I’ll be able to convince you there is something behind it, with the help of some recent history that might worth revisiting.

As a segue, let us start with another event that was announced recently that might contribute to this discussion: Cerner’s acquisition by Oracle for $28.3 Billion. Naturally this sounds like a very big number. But considering Cerner’s $5.7 Billion in revenues TTM, it is less than x5 multiple on current revenues. To emphasize, this is a strong 2nd market leader in the US (Epic and Cerner have more than 55% of the entire EHR market, and are pretty much a duopoly in terms of large hospitals and health systems) with substantial worldwide presence getting x5 multiple on current sales, after a 20-25% premium provided by Oracle. Not really a tech or SaaS multiple.

Part of the reason is that the EHR business still predominantly revolves a lot of service (the extreme part is onboarding, it’s hard to think of a more painful onboarding for a new software than a large hospital switching to a new EHR…) – more on that below.

Cerner’s acquisition and consequent diving into the dynamics of the EHR market made me wonder if we can/need to deduce some lessons from it for telehealth. There seem to be a couple of really substantial overlaps that might suggest the future of current telehealth companies can be predicted from the history of EHR companies.

“Apparent” silver bullet moment

Like COVID for telehealth, EHR had its own silver bullet with Obama’s HITECH and ARRA acts (2008) which were later translated into CMS’ Meaningful Use (2011), incentivizing the deployment and utilization of EHRs with a staggering $38 billion. It also came 15-20 years after these products started to stabilize (EHR is a bit more complicated to track but Cerner going public in 1987 seems like a good reference). It’s important to note that this was an untapped market, with only ~20% (!) of healthcare based on digital health records. That number leapfrogged within just a decade to 95%! (Take that, telehealth visit COVID bump…)

Source: ONC and FT partners/QED

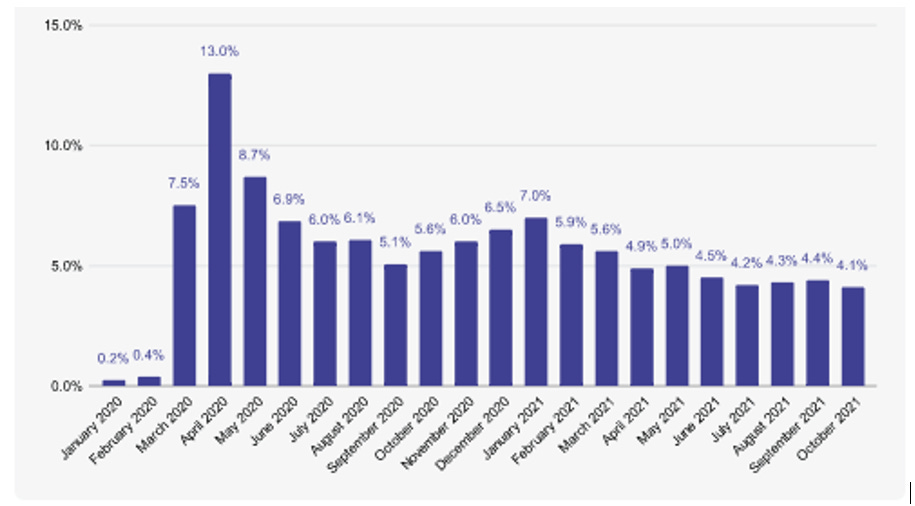

Source: Rebecca Pfizer/Healthcare dive. Fair Health data

In the mid-late 2000s, there were ~1,000 EHR players that were either started or fueled by what seemed to be a bit of a singularity point in time, all trying to gain market share with hefty venture capital support. A similar trend is seen for telehealth since 2019. Based on a Silicon Valley Bank 2021 investments and exits report, US and EU funding for alternative care companies exploded by 500% in two years, from $3.1 Bn in 2019 to $14.9 Bn in 2021 – a much bigger increase than any other segment.

Driving down costs or improving quality of care

In hindsight, running fast to gain grounds resulted in releasing products that weren’t fully operational and focused much more on the financial aspect (billing) than the clinical. Consequently, the promise of a more efficient health system due to digitization by EHR was eventually proven incomplete at best. Today, 30%-50% of physician burnout is attributed to EHRs and there’s compelling evidence that costs of care weren’t reduced, like in this 2017 meta analysis:

“This review identified some benefits in the quality of care but did not provide evidence that the implementation of eHealth interventions had a measurable impact on cost-effectiveness in hospital settings.”

What about telehealth and its promise to provide better access to (more affordable) care? Although there are some optimistic voices like this recent internal study from Cigna (with conclusions that are debatable at best, in my opinion, lacking the backing data for starters), other data suggest that the current form of telehealth does not necessarily drive more efficient care – rather, in many cases it would create greater and even duplicative total healthcare utilization and costs.

25% of the US population still do not have access to telehealth due to insufficient internet bandwidth or lack of smartphones and 15% struggle to pay for internet. Considering that these are perhaps the most important target users (higher chances they also do not have proper access to health services) and instead, the average users are of higher socio-economic class that usually have sufficient access to in-person care, for me that signal the potential for over-utilization of healthcare services and being in a bad place in terms of cost-effectiveness.

Service vs. software

Pushed by the aforementioned incentives, even without strong supporting clinical data in the early 2010’s EHR companies started to sign large contracts with health systems with the promise of much more digitized and efficient work, both at the hospital- and the system-level (as medical information would, for the first time, be unlocked and truly interoperable… How optimistic we were in 2010…). However, these promising plays turned out to be endless onboarding nightmares, resulting in tremendous additional costs and much frustrated healthcare professionals.

The ugly truth is changing workflow (moving from pen-and-pencil to EHR or in-person to virtual) is REALLY hard and necessitates A LOT of boots on the ground, hence heavy on the service side of things. Enter the Cerner 4.5x (service driven) multiple.

This is a piece from the Dec 2020 telehealth article I mentioned above –

“…telehealth sounds like very lucrative, high margin business. Yet “legacy” virtual care companies such as Teladoc and AmWell are consistent bleeders and despite the volume surge generated by COVID-19, their margins remained pretty much unchanged, y’-y’ and q’-q’ (GM of ~60% and ~45%, respectively). Both would still generate negative EBITDA of ~$100M in 2020…”

On top of onboarding, the current product telehealth vendors offer is hinged on utilization of physicians or other health professionals. If they choose the direct employment path, either as full/part time/on demand (via the Wheel and SteadyMDs of the world) it becomes a very costly line item in their budget (see above), and that is only if they succeed in overcoming the painfully growing challenge of having sufficient access to a group (physician, nurses, etc.) that so many companies are competing on. The other option is to be a “platform” (convener, virtual infrastructure…) for health systems, which pretty fast makes the health system and payers think, well we are in fact supplying the biggest asset in this offering, so why do we need to pay so much/don’t we build it in house?

Lack of a moat

The third quarter of 2020 had two watershed marks for telehealth: the market leader Teladoc acquiring Livongo for $18.5Bn (cash and stock) and the second in line AmWell going public. In 2020 TDOC facilitated ~10M virtual session, AMWL ~3.5M and number #3 and #4, DocOnDemand and MDLive, around 2.5M. Only one year has passed and it seems like the package was reshuffled with many new entrants, either incumbents adding virtual arm or newcomers. Here are just a couple of examples:

Optum’s new virtual care product has gone from having 0 lives at the beginning of 2021 to 14 million in the network next year.

Amazon care went national and continues to expand its hybrid virtual/in-person offering.

MDLive was acquired by Cigna (i.e. 2nd payer with in-house telehealth capabilities),

DocOnDemand merged with GrandRounds

Verizon launched BlueJeans

Doximity pushed its virtual visit offering and had 63M (!) virtual visits in the fiscal year ending March 31, 2021, and announced a strategic collaboration with Press Ganey.

Consider these ultra-fast market dynamics, it sure seems like the barriers to entry are exceedingly low and there is a very limited moat for the traditional telehealth providers.

The EHR market had similar market dynamics over the years. For example, take this piece from KLAS’ 2009 annual clinical market share report:

"Changes in the CIS (clinical information systems) marketplace as a result of ARRA seem to have blindsided some vendors and left them struggling to stay afloat in the large hospital market," said report author Jason Hess." In 2009 Eclipsys, GE, McKesson Horizon and QuadraMed all lost more hospitals than they gained; they are struggling to regain lost ground."

All of the companies mentioned here are now less than 10% of the EHR market, combined.

https://klasresearch.com/article/us-hospital-emr-market-share-2019-report/536

It’s important to mention that scale has a more important role for EHR than telehealth and can serve as a real moat. EHR vendors (still) govern the data and to some extent the IT infrastructure for health systems. EHR migration is a nightmare (i.e. superior product stickiness). And yet, perhaps you see the aforementioned market dynamics.

The result - EHR (and telehealth) as a commodity

How did the EHR story evolve? In 2021, the top five players (with Epic at ~30% and Cerner at >25%) account for 80% of the market. The bottom 10% is composed of 200 competitors fighting for leftovers. And we already mentioned the number around Cerner’s acquisition. Finally, see what happened over time to Allscripts and NextGen, some of the prominent EHR contenders. Both are trading at similar levels to ~2005 (just to benchmark, NASDAQ had ~100% increase over that time).

Similarly, and as already started to happen, I think we will see more changes in the telehealth landscape, and the current companies who are considered category leaders won’t necessarily be in a similar position in the years to come. In the foreseeable future, like with EHR, the growing number of available and comparable (i.e. with limited moat) solutions will push telehealth prices down. Enter the notion of telehealth as a commodity. It sure seems like companies well understand this threat and try to develop additional layers to their offering (such as Teladoc entering chronic care management via the Livongo acquisition, and a similar play aspiration by MDLive/Cigna with it’s new health monitoring program for chronic conditions and AMWL with coverage).

Driven by this price pressure and proliferation of more and more telehealth solutions it seems like the next chapter in telehealth will unfold like what happened in the EHR segment:

Increasing consolidation (Allscript/Practice Fusion) aimed at creating a moat by volume of users/physicians on the platform and leveraging M&A opportunities due to decreasing valuation due to ongoing weakness of comparable publicly traded companies

Combined with growing price pressure leading to the anointment of a couple of market leaders (Epic, Cerner) with sufficient size and breadth (covering different diseases/use cases)

Long tail of companies competing for niche markets (ambulatory EHRs).

Departing thoughts and opportunities

Dense competitive environment and rapid changes in a market do not necessarily mean only bad things. If played wisely it can also create substantial opportunities. Using the EHR story for that aspect as well, one can suggest Athenahealth as a relevant case study:

Going public in 2007 at ~$1.2Bn valuation (after 50% monthly increase from the initial IPO level) at the pick of EHR hypercycle and only going up since then (discounting the 2008-9 market meltdown)

Taken Private in 2019 for $5.7Bn by Veritas Capital and Evergreen Coast Capital

Acquired by a different PE group (Bain Capital and Hellman & Friedman) in Nov 21 in a $17Bn deal

The numbers are even more impressive when you consider the meaningful legal disputes around the company and that it’s revenues are far lower than Cerner’s.

The drivers for Athena’s charm are very relevant to today’s telehealth players as well:

Large enough niche market - Epic, Cerner and other large EHR vendors focused on large hospitals and health systems per the LTV of such clients. Athena (which actually started as an OBGYN clinic!) target another segment - the ambulatory care centers and work with ~120 different specialties. One example for telehealth might be the mental health domain, where it seems that virtual visits can capture much more than in other specialties.

Enable access to users who are currently “excluded” - for the smaller clinics and ambulatory centers, paying the original prices of migration to Epic or Cerner was simplify out of question. Athena and other specialty EHR vendors developed more nimble products that can be a better fit for them, also with respect to pricing. Within telehealth, any solution that can address even part of the 25% of US population who currently do not have access can have a huge impact (as this group might be the one who can benefit the most from access to virtual care).

Expand the use cases - Athena was and still considered a more “tech-driven” EHR. Part of is hinged on their early moves around cloud infrastructure and mobile access years ago (as a reference, some EHR are still mainly on-premise, hence the challenging on boarding and migration). For telehealth, any solutions that can increase the clinical team’s capability to deal with more types of diseases more effectively would be of much value (for example virtual encounter with a patient suffering from abdominal pain - where physical exam is a must). Combining virtual (synchronous and a-synchronous) and in-person care in an efficient manner is highly relevant to this end as well.

Make onboarding easier - Cloud infrastructure and mobile access are relevant here as well (EHR). For telehealth, when in many cases a patient will meet a random physician (i.e. not his usual GP), streamlining and efficiently converging all the relevant data regarding the specific patient with a great UI can be tremendous.

These are just couple of the ideas. One thing is certain. This is a great time to be a part of the healthcare industry, with such tectonic changes and meaningful opportunities as a by product.

If you are targeting one of these ideas, have additional thoughts on differentiation/moat or just want to chat on better ways to provide more efficient telehealth, we at Arkin would love to meet and help if we can!

As always big thanks to Sam Cronin from our team for his help!

Stay tuned!