Did large tech finally figure out their healthcare strategy (and divide the industry between themselves?)

Jeff Bezos, Tim Cook, Mark Zuckerberg, Sundar Pichai and Satya Nadella were just heading off the back room of the small restaurant. Nothing but smiles and hugs were seen.

A breathless waiter emerged right after them. “You forgot the map you were working on all day!!” but they were already on their way. Not realizing what he was holding, the map was tossed away until now being found.

Not sure if the leaders of Amazon, Meta, Alphabet and Microsoft are Games of Thrones fans (may Zuckerberg?) and obviously this is fiction (or not?) but multiple attempts (over the last decade?) have been starting to converge on what seems like the outcome of such a meeting. “Let’s divide the world between us, and each one will have just a large enough piece of the $5 trillion industry we have yet to conquer”.

“Winter is coming”

There were several meaningful announcements by the large tech companies related to their healthcare ambitions over the last couple of years. (Jeff Bezos - 2018, Tim Cock - 2019, Sunday Pichai – 2020)

On top of some short term effects on the stock market (3% drop for all national health plans!), these announcements mainly drove another game – bashing their futile attempts (1, 2, 3, 4).

Is it time to admit things are starting to mature?

Amazon – Care provision revamped

I’ve touched a bit on Amazon’s potential for virtual-first care in a previous post almost two years ago.

It is perhaps the best company (perhaps expect in China) when it comes to combining virtual (eCommerce, AWS) and physical (shipping and stores, with ~500 Whole Foods stores in the US) which actually makes them the best candidate to deliver hybrid, virtual-first care – given we agree care cannot be only virtual. Another crucial (and costly) requirement for V1P/new-comers in tech-enabled care is patient acquisition. Amazon Prime creates immediate access to >50% of US population, with Alexa, Audible and even AWS as other S&M channels. Amazon is also one of the largest employers in the US which drove the (ultimately unsuccessful) Haven initiative but also promoted the creation of Amazon Care. However there is more beyond it.

Primary and acute care – the newly announced One Medical $3.9Bn acquisition, provides access to 188 practices in 25 major markets with a particular focus on the commercial population (i.e. employers). It comes as additional layer of hybrid care layer (clinics + telemedicine) on top of Amazon care that was nurtured as an internal program for combined telemedicine and house visit care (2019) and was gradually expended into an external nation-wide offering. Not to forget the collaboration with Crossover health (announced in 2020) that is targeted internally for Amazon’s employees. Different elements revolving the provision of virtual first primary care with enhanced access, efficiency and user experience as Amazon is probably the only organization that can guarantee - “enabling access to medical professional in 60 seconds or less”.

Much has been discussed about the One Medical deal (Michael Greeley’s post is excellent as always), so I’ll be brief. First of all, it seems as a “Whole Foods-like” play aimed at leveraging physical location (and the physician network) as another venue to engage patients. On top of that remain two fundamental issues. Would OM continue to be a separate entity or would AMZN go down the rabbit hole of tech (EMR) integration between Amazon Care, One Medical (and Iora)? Second, would they keep Iora (adding Medicare, risk-based population into the mix) or continue to focus on commercial population and diversify it? My guess is the latter as it is much more focused and thus sounds more Amazonian.

Amazon Pharmacy (AKA Pill Pack + Prime) is adding a very meaningful, necessary (and often outsourced) layer for care provision. You met the doctor (virtually or in-person), significant chances the next step would be drug prescription. Why not closing the loop in-house (and keeping the revenues)? Amazon pharmacy is based on Pill Pack’s $750M acquisition in 2018 and now available in all 50 states, 24/7 and even includes discounts for Prime users.

Devices for home care (with a particular focus on diagnostics?)

Alexa/Echo – multiple healthcare related attempts with Alexa have been done so far and I think a fair definition for them would be “exploration”/small-and-not-so-successful pilots (1,2). I think it is still yet to be determined if Alexa can be leveraged in the foreseeable future to really augment Amazon Care/Pharmacy or perhaps remain a nice gadget (diet reminders, etc.) with the potential of clinical voice-enabled biomarkers in the mid-late term.

Halo – launched in 2020, this band / bracelet (i.e. Apple Watch / Fitbit competitor) for health and fitness tracking is perhaps Amazon’s attempt to go deeper in the remote monitoring (and diagnosis) realm by incorporating more vital signs on top of voice (which is currently only a surrogate). They jury is still out, but there is a good chance Amazon will partner with / buy similar solutions to expend capability to provide more care at home.

Amazon’s story in healthcare doesn’t end here as we still have the AWS side of the house. It is the largest cloud service and like an octopus with tentacles to every corner of healthcare and life sciences (payers, providers, pharma, …). As such, going forward AWS might be the canary in the coalmine when it comes to Amazon’s ambitions on top of pure provision of care – for example the addition of MSO layer or payer-facing solutions. Nevertheless, it seems that currently the AWS strategic angle is still in the making, with a couple of initiatives under AWS for health (for example HIPPA-compliant tools like Amazon Comprehend for NLP and Transcribe for speech-to-text) that seem more like a cloud infrastructure selling endeavor rather than something more, well, comprehensive.

This is actually a good segue to the company which seems to anchor its health strategy around its cloud: Microsoft.

Microsoft – Provider operations and workflow infrastructure 2.0

Microsoft is the 2nd largest WW cloud provider in healthcare after Amazon, but as opposed to the former, MSFT has very deep roots in the back office side of things with Windows and Office 365. Like other big tech companies, they had an quite epic attempt to compete with…Epic, with HealthVault‘s decade-long attempt. But in the end they felt what it’s like to try to enter a walled garden when you are not the owner of the garden (hey Win 95 + Explorer…). Nevertheless, and perhaps similar to the Amazon/Haven story, maybe this endeavor was the steppingstone to what seems to be a much more cohesive strategy to leverage MSFT enterprise software and B2B sales capabilities.

Since the EMR attempt, Microsoft has been adding different (and complementary) solutions for providers’ operations and workflow.

Microsoft Teams – both for internal communication/collaboration and as a telemedicine platform which gained a lot of traction during COVID (it was actually ranked first in (general) video conferencing platform for healthcare by KLAS) and is semi-integrated in Epic via the ‘EHR connector’.

Voice-enabled (mostly scribes for now) and AI solutions for operations (radiology in particular) via the Nuance $19.7Bn acquisition in April 21. One may claim the main target of the acquisition isn’t Nuance’s technology or products (which surpass voice-enabled plays) but actually a land-grab, as it is used by ~80% of the hospitals in the US. Since one of the biggest obstacles in selling to healthcare enterprises is crossing the gate and closing the first contract, this can be a Windows-like enabler to upsell opportunities.

Chatbots for patient engagement – healthcare conversational AI at it’s (current) best. This B2B solution help providers establish their ‘digital front door’ with content, triaging/symptom checkers, navigation, and scheduling solutions.

Launching Cloud for Healthcare (Oct 2020) to bring together these different “capabilities” including also data collection from IoT devices, FHIR support and APIs and a wide spectrum of security solutions for data protection. Microsoft on-boarded significant “strategic partners” like Humana and Allscripts.

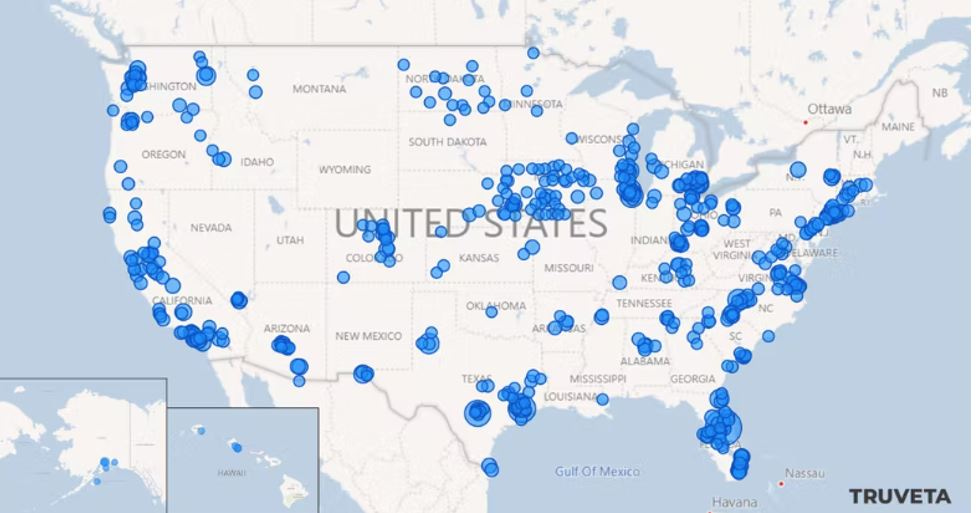

Finally, providing data lakes via Azure for specific data sharing and analytics. Truveta is a great example here, with ~15% of all US patient care providers (and some impressive lighthouse accounts) as members in the de-identified data platform launched in 2020.

Did someone forgot to call Intermountain?

Alphabet – clinical data enabler

Moving to the more clinical side of workflow solutions, Alphabet / Google has been trying for years to leverage data and AI to drive better care. Nephrology, pathology, ophthalmology, oncology and dermatology are a couple of examples for testing the water of diagnostics and clinical decision support. These attempts haven’t led to anything at scale (though they did to a couple of reorganization attempts) but perhaps they convinced the data giant they should be more focused on the actual data. What is Google’s special force if not digesting incomprehensible amount of data and providing insights from it? In other words, instead of developing specific decision support tools, moving to being the enabler for others to do it. Google have made impressive strides in creating partnerships with providers to make better usage of their data (and trying to push Google Cloud in the back door, ala AMZN and MSFT).

CareStudio – Clinician-facing, EHR search and organization tool (Google Desktop-like for EHRs) which seems like the cornerstone here.

Data indexing, standardization and interoperability tools

The Healthcare Data Engine “can map over 90% of HL7v2 messages to FHIR across leading EHRs” via the Google Cloud Healthcare API and BigQuery

Healthcare Interoperability Readiness Program targeted at compliance for the Cures Act regulation

NLP for unstructured data

A crop of collaborations with health systems around the development of predictive analytics (in the last 18 months - Northwell, Mayo Clinic, HCA, Highmark )

Being a “data enabler” is not only relevant for care provision but also for clinical studies. Enter Verily.

The Verily story (which also involves the surgical robotics entity Verb) seems like an attempt to be the de-facto middleware for clinical trials. Verily is combining growing real world evidence datasets for research that also unlock opportunities for patient recruitment (Project Baseline; for example see this announcement from Otsuka) together with tools for clinical trials execution (software like SignalPath, which was acquired in Aug 21, and a 510K-cleared Study Watch). So either doing research on data provided by Goggle or initiating a study on a new population, Verily can help. They even partnered with the FDA around the open-source app MyStudies – a platform for collecting and reporting real-world data for regulatory submissions.

Another wearable under Alphabet’s umbrella, is Fitbit and its $2.1Bn acquisition cost. This one is frankly still not clear to me. It has survived the reorganization and undoing of Google Health but is it just an attempt to compete with Apple and Samsung? Will it merge with Verily (not sure per the different D2C approach)?

DTC outskirts and behind the wall

To me it seems these three (Amazon, Microsoft and Alphabet) are the most cohesive (and most advanced?), as reflected in the map above. Some thoughts on the others (Apple, Meta, Oracle) -

Oracle is kind of the new-comer (and much smaller player compared to the last three) in the “let’s find a wedge (Cerner/EHR) to push our cloud in healthcare”. Worth mentioning their ERP solutions as well.

Apple just released a 59-pager on its healthcare endeavors and plans to date, titled “empowering people to live a healthier day”. The word “healthier” is key here IMO, as it implies preventive care (non-clinical or mostly DTC in nature). If I need to single out Apple’s edge it would be their ability to provide the best D2C hardware. Smartphone, tablets, earphones and watch. More specifically, one of the core problems device-centered remote monitoring companies have competition on “body real estate” (wrist, in particular) head-on with Apple, probably the best design studio in the world.

In that case, the Apple Watch seems like the best and most relevant healthcare play from Apple, as the center of their direct-to-consumer approach (“the future of health on full display”). Its health features are constantly expanding (FDA-cleared as ECG, irregular heart rhythm notification, falls, and now for Atrial Fibrillation “history”) and a bunch of collaborations around new capabilities and research applications. In that perspective also need to add the open-source research tools ResearchKit and CareKit.

The second, rather significant, element but still TBD on real potential is Apple’s personal health record, allowing users to turn their iPhone into their PHI vault – aggregating, visualizing and sharing data. On the one hand, Apple has done similar things before (Apple Wallet) and having 100M iPhones out there is a lot of potential users, but needless to say that convincing people to share their health data, on top of aggregating and converging data from different sources is still far from being trivial. Let’s see.

Meta is betting its future on the Metaverse and accordingly digital therapeutics and remote monitoring seem like very relevant pieces (care via emulation of in-person encounters in the virtual space while leveraging sensor in the oculus to capture vital signs) as opposed to other AR/VR plays (training and education for example), per the more consumer focused mindset of Meta.

This is also kind of the first inning for them in healthcare but if Meta will indeed conquer the metaverse, then the potential to be the middleware for digital therapeutics is rather significant.

Closing words - Song of ice and fire

One practical reason to dance around the question of “what is the future for big tech in healthcare?” is the potential for competition and also for the acquisition of a myriad of companies, per the massive piles of dry powder (and non-cash options) these guys have. In other words, knowing where these 800-pound gorillas are heading might help you to either plan an alternative route or make sure you stay exactly on their course, hoping to be picked up.

Obviously, there are many more initiatives, projects, and semi-launched ideas. This was a mere attempt to gather the core of what seem like the more robust, strategic plays (with real potential for meaningful impact) for each of these players. Also, the common theme here is what seemed to be a process of self-reflection by these giants while burning A LOT of capital that is actually starting to crystallize what their strengths are and as byproduct where they actually should play (and where not). Whether they will succeed is still an open question but at least the attempt looks much more focused and cohesive at this point, which is not something to take for granted, especially in healthcare.

As always big thanks to Sam Cronin from our team for his help!

Nadav

Subscribe to easily receive new posts!

Let us know what you think!

solid insights! I think the PHR element is quite underrated overall and will be making a comeback when properly tech enabled and embedded into retail phenotypes that patient-consumers actually get to drive with primary care physician co-pilots