The elusive promise of remote patient monitoring

(Or... why we won’t invest in stand-alone wearables)

In the past few months, the remote patient monitoring (RPM) sectors has been very active. A surge of M&As (Philips / Biotelemetry for $2.8Bn and Capsule for $635M, Boston Scientific / Preventice for $925M and HillRom / Bardy for $375M) combined with (and driven by, to some extent) “COVID fuel” as RPM companies check the boxes of “digital” and “at-home”.

Consequently, it seems like RPM is one of THE sectors to be in.

Well, I’ll try to challenge this notion in this post. Actually, some parts may also be relevant to other fields within digital health such as decision support tools and chronic care management solutions.

Want these posts instantly in your mailbox?

The push for remote monitoring and remote chronic care management (which are different concepts yet overlaps to some extent) has actually been building up for couple of years. IMO 2016 was the watershed moment, when CMS initiated coverage for remote chronic care management. Since then it has expanded (in terms of $$$, flexibility and including remote monitoring ). In parallel, the FDA’s notorious precertification program that was announced in 2017 was heavily built on RPM with ~50% of its participants addressing this sector and consequently now in possession of FDA clearance for their wearables (Apple, Fitbit, Verily and Samsung). Fast forward to 2020-2021, COVID’s created a sizeable positive effect on RPM (and providing care from a far) that has long been discussed and hailed.

If you monitor (track) it, they will come

The thing is, when you follow current RPM solutions back to their early days as purely “activity tracker” (leaving aside the Cardionets of the world two decades ago) one can truly be impressed how the user experience / interface had evolved. However, its far from being the case when examining the business models around such technologies, or in particular how they truly create value (and thus can capture some of it).

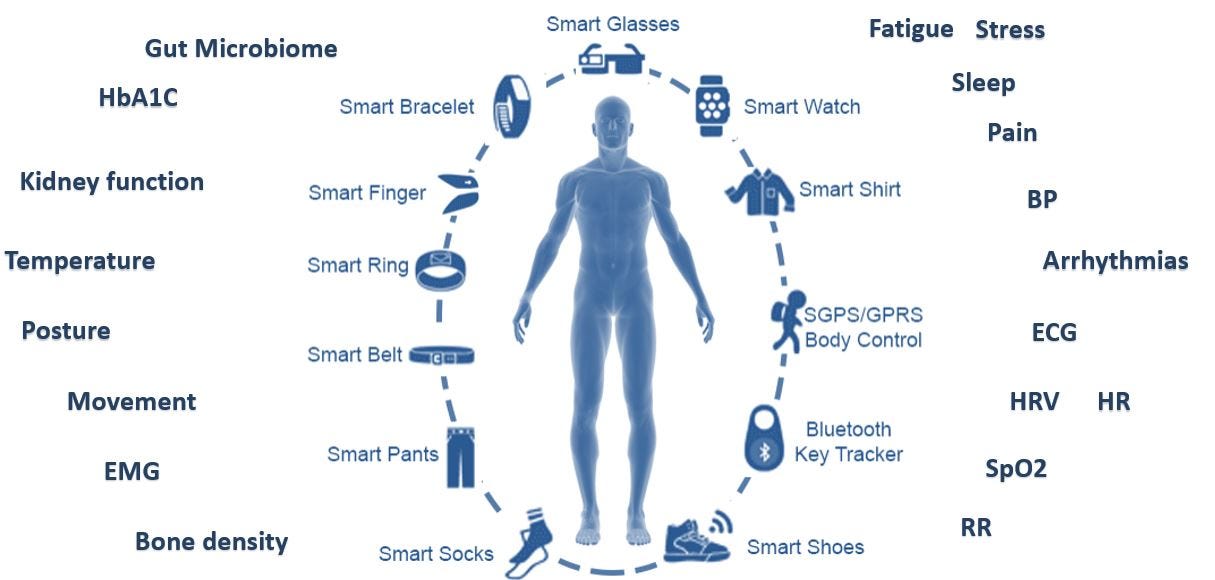

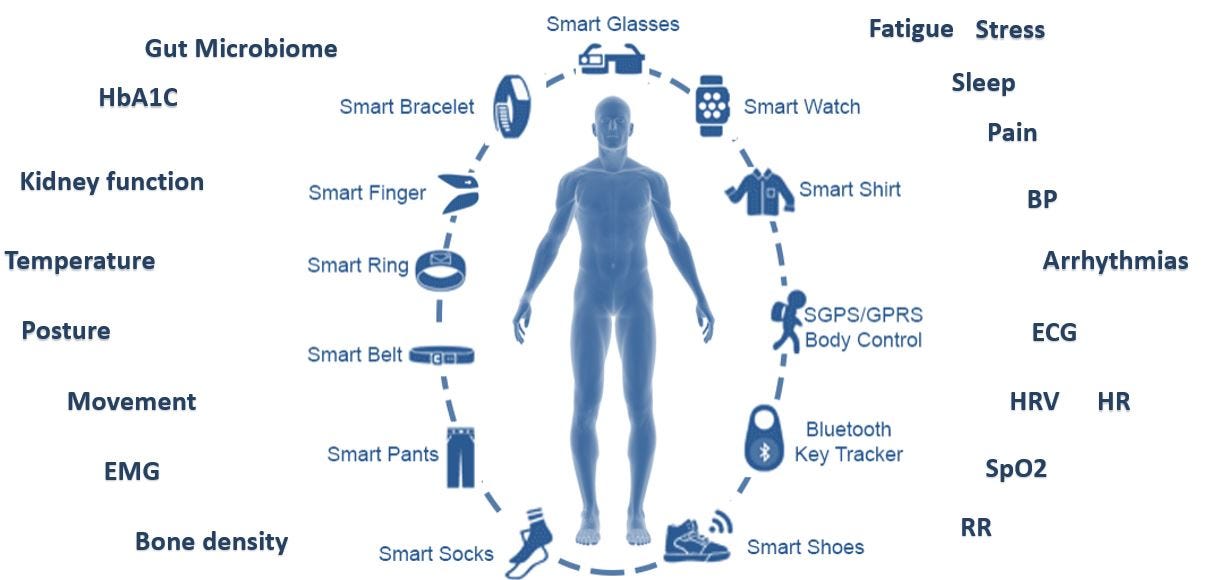

Back in 2015, when I was working at Accelmed (back then the leading Israeli VC Medtech investor), I was given the task of analyzing the surge of activity trackers / wearables and provide a recommendation – should we want to start investing in this field. We had MANY companies approaching us, all with a similar notion in mind – they will capture as many vital signs as possible (some are well accepted, some are new to most physicians like heart rate variability), in a continuously and accurately manner as possible, send everything to the cloud for “analysis” and magic will happen. Sounds a bit familiar?

I would not presume GTM strategy not evolving throughout the years is necessarily a bad thing (I guess in case it works) but there are some fundamental problems with this approach, both in 2015 and in 2021. Following are some hurdles RPM and wearables companies are facing (most without great deal of success). Furthermore, each of the following is substantial by itself, but bear in mind that usually all of them will exist (and thus must be solved) in parallel.

1. Not enough real estate or distinct signals

Trying to have someone wear / patch / carry something isn’t an easy task. Even if you are able to provide sufficient UX in terms of convenience and fashion, there isn’t a lot of “available space”. Indeed, entrepreneurs can be creative and think about more sophisticated ways to offer something (allegedly) different, but one would argue that there is also a limit to the amount of accessories the average person will accept.

Now, consider the gamut of available solutions. Here is an attempt to cover just FDA approved devices by main indication (and by all means this is not a complete nor flawless list)

ECG and arrhythmias (patch / bracelet) – iRhytm, BioTelemetry, AliveCor, Fitbit, Apple watch (+falls), Samsung watch, Verily (watch), InfoBionic, VivaLNK, MediLynx, VitalConnect…

Atrial Fibrillation – Apple Watch, FibriCheck (video), PhysIQ (add-on software), Biofourmis (same).

Blood pressure – Omron (wireless cuff), BioBeat (IL, Patch / watch), Aktiia (CE – watch-like), Samsung watch (CE only), LiveMetric (IL, Watch, pending approval by Q1 2021).

Respiratory parameters

SpO2 (+other parameters) – Philips, Spry Health (acquired by Itamar - IL), Oxitone.

Smart inhalers - Propeller Health (Acquired by ResMed), Teva (IL), AireHealth.

Spirometer - Cohero Health, NuvoAir (Pond).

General vitals (HR, RR, temp, movement and more) - Current Health, VitalConnect, VivaLNK, Hello Heart, toSense (CoVa), MC 10, Earlysense (IL, Contactless - HR, RR, SpO2)

Sleep – Withings, Eight sleep/Luna, Itamar (IL).

EEG - Dreem (handheld EEG), Headsafe, Zeto.

Obstetrics (US / fetal heart) – Pulse&More (IL), Nuvo (IL).

Seizures – Empatica (FDA approved).

Pain - SPR Therapeutics

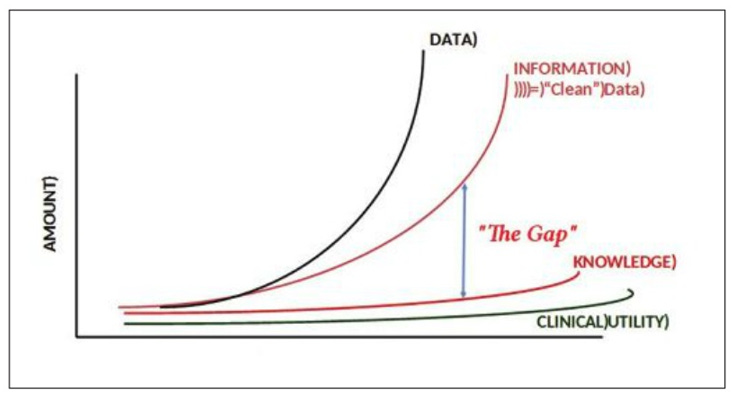

2. There is a substantial difference between data and actionable insights

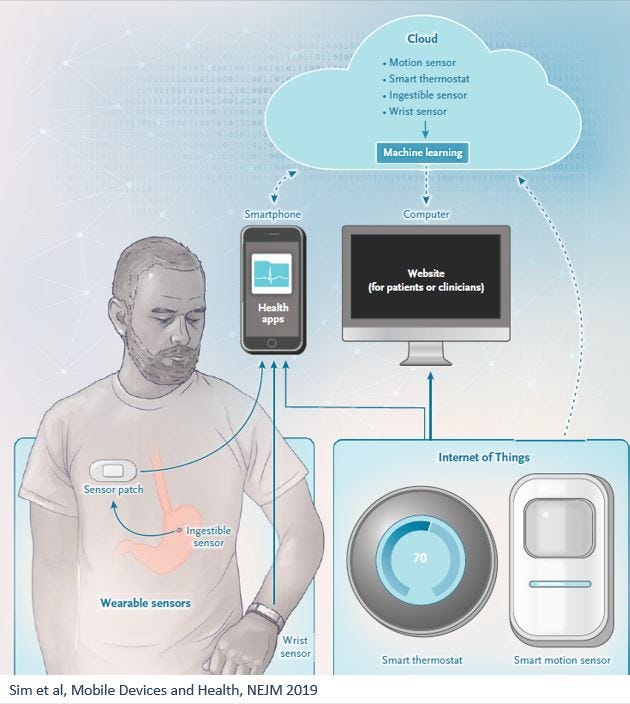

Sim et al published a nice review on remote monitoring on NEJM in 2019 , mentioning that “tracking and reporting data are means to an end, not the end itself.”

IMO this is a fundamental aspect that is too often ignored by companies (newcomers and incumbents alike, and very much not limited to RPM). There is a huge gap between capturing data and leading to actions based on this data (and let’s not even get started on the topics of changing workflows and patient workup). Data by itself is almost useless. It has to be cleansed (to avoid too frequent garbage-in- garbage -out scenarios), transformed into knowledge (infer what is the meaning of this data) and then transformed into actionable insights (what should someone do, based on this knowledge).

Source: Michael N. Liebman

Let’s take non-ICU continuous blood pressure monitoring as an example.

Current guidelines for BP management address daily measurements (and extreme surges within this framework such as malignant hypertension), which essentially means physicians don’t know how to react to anything more frequent. Let’s presume a patient has 10 mm Hg systolic spikes for 5 seconds twice a day and he is already on antihypertensive medications. Do you alter the treatment? Call the patient in? No clear answer. And please don’t bring the “we use sophisticated AI to analyze the data…” it doesn’t mean anything unless you have clear and validated outcome (and sufficient model performance). To date there only a few real use cases for such approaches. (even with multiple attempts to utilize RPM to predict COVID outcomes).

3. Target population and specific use case (and the false positive danger)

If we agree the purpose is not to monitor for the sake of generating more data (and thus just to add more tasks to providers who are already buried under piles of work) but rather to tease out actionable insights, there most be a specific outcome for a specific target population. Furthermore, to avoid the intolerable scenario of creating extra-work, reducing false positives is key.

Atrial fibrillation can serve as a good case study here.

The rationale of early detecting atrial fibrillation is well established:

Huge target population, predominantly elderly (0.1% prevalence in <55 years old, ~5% out of the entire 70 years old population, ~10% in >85 years old).

One of the leading conditions for stroke (and perhaps #1 for cryptogenic stroke).

~25% have no symptoms or only experience paroxysmal manifestation and therefore remain undiagnosed (but have similar risk for stoke!)

There is a clear therapy to reduce the risk for stroke (NOACs - apixaban, dabigatran, rivaroxaban) which also creates an incentive for pharma. (~75% of strokes related to A. fib are preventable)

Apple is among many players trying to capitalize on this situation. Its watch is FDA approved for such task but what is the actual value of monitoring people for A. Fib using a smartwatch?

Apple executed one of the biggest prospective studies in history (419,297 subjects) trying to answer this question, but their results were problematic, to say the least.

Among the 420K participants only 5% were 65+ years old (meaning wrong study population). Over median monitoring time of 117 days, “irregular pulse notifications” were received by merely 2161 participants (0.52% !!), and only 945 (0.25%) underwent further evaluation. Out of the 945, only 404 (0.12% of total study population!) “reported a new atrial fibrillation diagnosis”. (420,000 vs. 404). That also means that the “cost” of each new diagnosis is another patient utilizing the system for no reason, despite being healthy (i.e. false positive).

A group from Mayo Clinic did a separate analysis of patients evaluated for abnormal pulse detected by the Apple watch. In their group of 264 patient (seems small, but as mentioned in the 420K study, only 945 had an alert), only 15% actually had any relevant cardiovascular issue!

Just extrapolate the A.Fib scenario with other conditions and imagine the consequences in terms of the additional strain on health systems caused by all these false positives (and perhaps better understand the why providers are so reluctant for new RPM solutions).

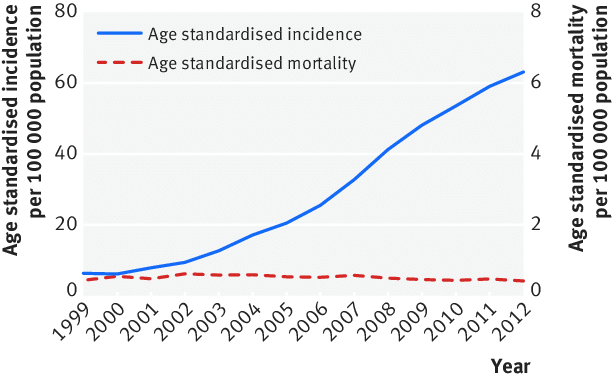

Simultaneously, and perhaps even more importantly, more diagnoses does not necessarily lead to better outcomes. Take thyroid cancer as an example, where improvement in diagnosis capabilities did not change prognosis.

Source: Park et el, BMJ 2016

4. Introducing new biomarkers is a LONG journey

A different approach is to identify new biomarkers. Biomarker can be a novel molecule or protein isolated from the blood (Amylase and Lipase for pancreatitis), but can also be based on external measurement via monitors (CO2 exhalation / capnography to ensure an endotracheal tube is placed correctly in the trachea and not in the esophagus). There has been a lot of work around heart rate variability (HRV) for example.

The promise here seems ample, especially if it is a novel marker that only your device can capture, and then down the line any physician around the world will use it (think about Troponin for acute coronary syndrome). However, when the rubber meets the road it is just super complicated. Just to name few reasons, you must make sure it can be generalized (i.e. applicable to different sub-population and scenarios), with clearly linked outcomes and in a replicable and affordable manner. In the last 3 decades, while medicine evolved rapidly, only a tiny fraction of all envisaged biomarkers were incorporated into clinical guidelines. According to several sources the average duration for such journey is >15 years.

5. Incorporating a new solution into the workflow is HARD

Lastly, even if a company succeeds in isolating specific actionable insight, it then has to overcome the workflow barrier. For example, lets say a certain RPM solution identified that someone will experience heart failure exacerbation (i.e. deteriorate from CHF to ADHF) within the next day. This information would have to be generated by the right population (keeping the A. fib case study in mind), double checked to reduce false positive alert, reach the relevant provider, and have the provider act accordingly based on this information. Real time communication, IT integration, and patient prioritization are just a part of the obstacles here, not to mention the system’s conservative state of mind.

Proteus (smart pill combined with an external patch that monitors drug adherence and other parameters) is a great example of this issue, where the target population and use case simply didn’t add up. (I wonder why someone thought that patient with schizophrenia will ever buy into something that monitors them….)

Indeed, recently there have been number of newly announced collaborations between data / IT players and RPM companies (such as Withings and Redox), banking on the 21st century cures act new favorable interoperability regulation, but this is still very early.

Lastly, given the unprecedented burnout of medical staff (even before COVID), and the direct link to computer fatigue, it will be challenging to convince providers to add more screen time. (and in case you are not familiar with Atul Gawande inspiring piece “why doctors hare their computers”, it’s a must)

What type of RPM can really succeed to generate commercial traction?

As a starter, the new expended RPM CPT codes do create an opportunity when utilized properly. When a provider isn’t administering remote monitoring to eligible patients, the RPM codes can provide new stream of revenues. The codes combination can generate $100-$150 PMPM, and even with a 50-50 rev-share with RPM service company the provider can still pocket an additional $50 PMPM. Not bad. Furthermore, there are actually additional / separate codes for specific indications (such as cardiac arrhythmias).

Nevertheless, this is far from being “money on the floor” (as too many companies present it) and there are substantial challenges that must be address as presented above. With this notion in mind, IMO it boils down to two major prerequisites for RPM companies:

1. Tapping into a well-defined point in the workflow with a CLEAR need.

iRhytm is a beautiful example, targeting A. Fib (and arrhythmia in general) in a much more cohesive (and boring to a good extent) way than Apple. It essentially fills major gap in traditional ambulatory cardiac rhythm monitors (by large, Holter monitors and cardiac event monitors) being uncomfortable devices suitable only for a limited duration. I can admit that even used for hospitalized patient (yes, in Israel it sometimes happens), adherence and results are not sufficient. This gap is meaningful for patients, providers and payors (“easy-to-use, clinically proven, cost-effective platform”) alike.

In short – well accepted workup (similar to a Holter monitor), for a specific population with high pretest probability (patients pre-screened by providers), with a clear place within workflow but only being more comfortable and with longer duration – both are crucial parameters for this modality.

Per their last 10-K, beyond their device iRhytm provides “final quality assessment review of the data by our certified cardiographic technicians” (reducing false positives…), “an easy-to-read Zio report, which is a curated summary of findings that includes high-quality and clinically-actionable information which is sent directly to a patient’s physician and can be integrated into a patient’s electronic health record”.

Extended Holter and event recorder modalities generate 90% of iRhythm’s revenues. It has 70% gross margin (Software margins in healthcare!) since 2016 and 45% CAGR since 2018 (excluding COVID).

All that couldn’t happen without an extensive ground work such as >30 peer-reviewed clinical studies (comparison to the gold standard - implanted pacemaker / Holter) and contracts with 95% of US payors (300M eligible members). And they do not say a single word on novel biomarkers 😊. To be fair, they do offer analytics (AI based…) but only as an upside and mostly for their internal funnel / triage.

BTW – among the companies that were recently acquired (mentioned in the beginning of this post) most have a very similar offering pertaining to cardiac electrophysiology monitoring (Biotelemetry, Preventice and Bardy).

2.End-to-end solution and not just a gadget.

Another important aspect of iRhythm’s value proposition is that they take care of the entire problem. A-Z. They don’t just provide their patch whereas the entire operation and all the deliverables required to remove this “task” from the provider (A.fib monitoring for certain sub-population). Trying to break it down:

Initiation of monitoring (order the device/s, shipment, patient on-boarding) —>>

Making sure the patient adheres to the prescribed regime (customer support!) —>>

Data generation, capturing and triaging —>>

Integration with the provider (IT, EHR, billing) —>>

Provoking the suitable next step in the (clinical) workflow.

The monitor by itself, not matter how advanced or unique, is a very small piece in this chain of actions.

Closing remarks

If you kept with me thus far, I hope I have succeed in convincing you that like other domains considered “digital health”, RPM is much more a “tech-enabled service” play than pure technology (pure device or pure SaaS). Actually, I would argue that in most domains the viable play is the former rather than the latter and the real question is how much service % you have and how / if you can reduce it over time.

Furthermore, as I’ve eluded in several places during this post, many of the challenges suggested here are relevant to other domains within digital health. In the next few posts, I’ll try to elaborate on that and hopefully suggest a framework with sufficient criticism to steer via the tremendous noise currently surrounding digital health.

Stay tuned 😊

Twitter: @Nadav_Shimoni

LinkedIn: https://www.linkedin.com/in/nadav-shimoni-m-d-03992489/

If you liked this post, you can easily share it here -

Want these posts instantly in your mailbox?

This is one of the most thought, confront reality as it is posts on healthcare I have ever seen. Bravo for such an excellent job.