Software and Pharma, moving beyond drug discovery

TL:DR - Is there a real opportunity for digital health companies to do more with pharma? Yes, but….

Why should we speak about pharma

I’ll start with a great post from Sam Cronin from our team, on the heels of a dedicated event we recently held on this topic:

“We get it – selling in digital health in 2023 is HARD. Granted, it was never easy, but we’re hearing the same things founders are:

“Provider finances are in a challenging state, you can’t get their attention right now with innovations...” 🏥

“Buyer fatigue for employers’ benefits managers is real...” 😴

“There’re only so many payers to talk to…” 🏦

But we also hear this: “Pharma have dry powder and a healthy risk appetite” 💊

Now, let the following numbers (thanks to Stifel) sink in for a moment:

As a digital health investor with a biotech bigger sister fund (Arkin Bio manage $500M, from first check to pre-IPO), the intersection of pharma and software is a logical area of focus for us. In the current climate, now seems like it may be a good time to try to crystallize where there might be real potential in this space, hence this piece and the dedicated event we recently held.

Want to be notified on our next event (IL, in-person)? Sign here

What “pharma” actually means

First, it is important to understand that like other sectors, different pharma organizations come with different size, breadth and areas of focus. Nevertheless, the core idea is simple – bringing a drug to market and monetizing it. Some companies will focus on specific parts of that value chain whereas others will try to pursue it end-to-end. From R&D (targets and drug discovery, clinical trials) to manufacturing and supply chain management through commercialization, there are potentially multiple areas where software can drive better efficiency.

Source: Novartis

As Tamara Mansfeld, Global Innovation Lead at Pfizer, put it: “There’s not one single bottleneck, it’s a series of bottlenecks”. This was reinforced by Samuel Scheer at Novo Nordisk (Digital Innovation Hub Lead South East Europe, Middle East and Africa), who added that “People don’t realise that pharma is completely behind, digital is just coming now. There almost no relevant solutions from big tech. Novo Nordisk is trying to implement very early stage startups because there aren’t established solutions from large service providers and when there are, they struggle with global rollouts…”

OK, but where to focus?

Over the last 2-3 years, it seems like two areas got a lot of attention at the crossroads of software/data and pharma: AI-based drug discovery and (decentralized) clinical trials.

I would actually prefer to put these two aside, as both seem at least at this point a bit like a red ocean, given the sheer amount of money that flowed into this sector (just to emphasize the difference from other pharma-facing solutions, this is the only one to make it to the top 10 digital health “funded value propositions” by Rock Health). ~200 financing rounds for clinical trials companies in 20’-22’ alone (!) created a ton of companies pursuing a very small set of customers / use cases.

This isn’t to say there aren’t opportunities there, but now feels like it might be more beneficial to highlight some less ’familiar‘ areas.

Supply chain and manufacturing

Not a big secret COVID created an earthquake in global supply chains.

For pharma, this is much bigger than just how to bring a drug to pharmacies. Even big pharma tends to heavily relay on an array of manufacturers (internal and external) to produce each drug. The components that are involved in the process tend to have different limitations (sterilization, temperature) that render their manufacturing and handling/shipping to be fairly complex. On top of that, there is a whole category of new drugs, based on cells or genes, that require new methods for production (extracting cells from donors, maintaining and transforming cells or genes, etc.) – an area still in its infancy and thus in need for efficient solutions.

And just to provide some framing, Novo Nordisk CAGR was single-digit for almost a decade before the introduction of its anti-obesity drugs (newest is Wegovy, launched in mid-21’) pushing its growth to 15-20%. However, this number could have been much higher, as the demand is simply surpassing the manufacturing and supply chain capacities of the company.

SG&A (Sales, General and Administration)

The cost of bringing a new drug to market is estimated around $2 B and only ~10% of new drug candidates will actually reach the finish line. When it happens, these drugs need to cover all the other failed development attempts and this puts a lot of weight around each commercialization process. Nevertheless, these campaigns often fail to meet their sales goals despite billions of dollars spent.

To further emphasize this, seven of the 10 largest pharmaceutical companies spent more in 21’ on S&M than on R&D for new drugs.

Source: IBIS capital

Like with supply chains, the pandemic heavily influenced sales and marketing for pharma. These efforts are usually two-fold – patient-facing (increasing awareness and adherence) and healthcare professionals (recommending and prescribing a specific drug).

Healthcare professionals (HCPs) essentially closed their (physical) doors for pharma reps during the peak of COVID, and they don’t seem to have reopened them since. Europe for example saw a 70% decrease in F2F contacts with similar numbers in the US. According to McKinsey, pharma reduced the number of sales reps by 35% in merely two years (20’-21’), with the liking of Novartis pursuing major re-organization including re calibration of its sales efforts.

This puts digital venues front and center, targeted at obtaining attention and overcoming the fundamental perception many HCPs have for pharma as ‘the villain. The name of the game seems to be quality of content while also addressing real needs of physicians, nurses and other HCPs. This shift also sets the stage for medical affairs (which focus on the clinical and scientific aspects of the drugs and traditionally were a supporting component for the sales process) to become de-facto the sales leaders for pharma (instead of traditional, non-clinical, sales).

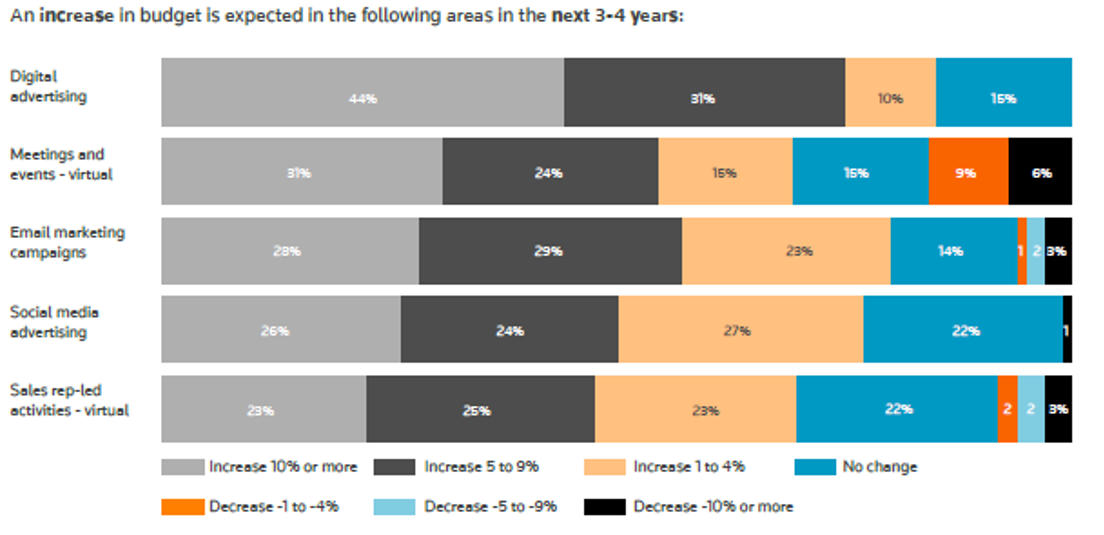

Source: Elsevier-Reuters report, 2022

To be successful in establishing these digital channels and capturing the attention of HCPs, a couple of key questions should be considered:

How to build a healthier, less transactional conversation that won’t look like you are just forcing a specific drug? How can you objectively create a, cleaner, and fact-based conversation?

What are the current limitations or barriers to provide more efficient care for the patients this particular group of HCPs are facing? How can this new product (objectively) address that?

What is the hook for HCP initial engagment? Why would a HCP open this message/attend this (virtual) session/read this article?

How can you create a more personalized experience for each HCP while still being able to reach a large enough population?

To note, there is also an entire host of challenges pharma are trying to solve around patient engagement and adherence. I think that much has been discussed on that angle (“beyond the pill strategy”) and per its breadth it is beyond the scope of this post; to that end I’ll just highlight some relevant pieces in case you want to have some more color:

Is pharma indeed a better choice?

Starting to wrap things up, I guess it boils down to the question ‘might pharma might actually be a better (or at least, more relevant) buyer for digital health?’ Like many other things in medicine the answer would be – ‘depends’.

Although their budgets tend to be substantial and rigid, pharma are also frequently slow(er?) to act and hard to convince, especially when it comes to moving from small and well-hedged pilots into large scale work. In that perspective you might say many providers and payers are similar, but pharma might also be quite behind when it comes to IT systems (outside of the R&D domain) and just being legacy organizations. Until very recently, “IT for pharma meant fixing computers” and not rolling new tech and cloud is actually fairly new concept to many pharma organizations.

Furthermore, reaching scale with pharma can be an excruciating experience, especially as business units are so specific to diseases and geographic locations (for example, IBD versus cancer – very different patients, HCPs, care settings, etc.). Too many times it seems like there is a real chasm to cross between experimentation (which can sometime come as 7-digit checks) or hefty TCV (total contract value) to real recurring and increasing revenue models.

In other words, you shouldn’t focus on pharma just because it seems like they have bigger or more defensible budgets and myriad of challenges. You should do it once you identified a specific problem and have an objective way to conveniently solve it in an efficient and scalable manner.

Pharma is driven by science and is traditional industry in healthcare, which means data and evidence are a must. Pharmaceutical companies are much more likely to engage with digital health companies when services deliver proven, measurable ROI. Therefore, when engaging pharma one should come prepared and be clear on what the value add is from the pharma perspective. What is actually there that’s of interest to them and how it ties into their strategy. It also means maintaining a strong essence of who you are and what you can/can’t provide.

Finally, a couple of large pharma organizations are very receptive to being design partners (because they are so early in their efforts) which can create a terrific opportunity when pursued properly to really understand what they are looking for, who in the organization is the relevant champion and what it the true potential of a certain product.

As mentioned at the beginning of this piece, for us as a digital health investor which resides in an organization with more than half a century of experience in pharma operations and 15 years in pharma investments, we are keen to find more tech centered solutions in this space, especially in the areas highlighted above. If you are building something relevant or consider doing something in this space, please reach out!

As always great thanks to Sam Cronin for helping with this piece.

Thank you for reading "Differential Diagnosis"!

If you are enjoying it, it would be terrific and super helpful if you can please spread the word with others!

Nadav

Let us know what you think!