Israel and Digital Health – much more than data, and what can be learned from New York?

Much has been said about the huge potential Israel has as a digital health powerhouse. One of the most common arguments is the breadth and depth of data available for research and development.

The Israeli healthcare system, composed of merely four HMOs (“sick funds”) that are providing care, by law, to all the Israeli population, underwent a digital transformation about three decades ago, fueled by the HMOs’ incentive to provide high value care as they operate under a capitated governmental budget.

This process happened long before many other countries started pushing digital infrastructure in healthcare, including the U.S. (actually in 2008, only 20% of the U.S. system was using electronic medical records even partially, and all the rest was pen and paper). Combined with the very low attrition rate (~1% annually) between the four HMOs, longitudinal and granular data accumulated in the Israeli system, the kind that can be quite compelling for clinical and business utilization. Nevertheless, other countries have been quickly narrowing this gap per the dramatic increase in utilization of digital capabilities (in 2016, already 95% of the U.S. system was using EMRs), and as a byproduct, Israel’s ‘data advantage’ is being reduced as time goes by.

Simultaneously, I would suggest a couple of other characteristics that might even outweigh this data potential and can perhaps strengthen the argument that Israel can in fact play a significant role in the global digital health industry.

But first we need to look at New York.

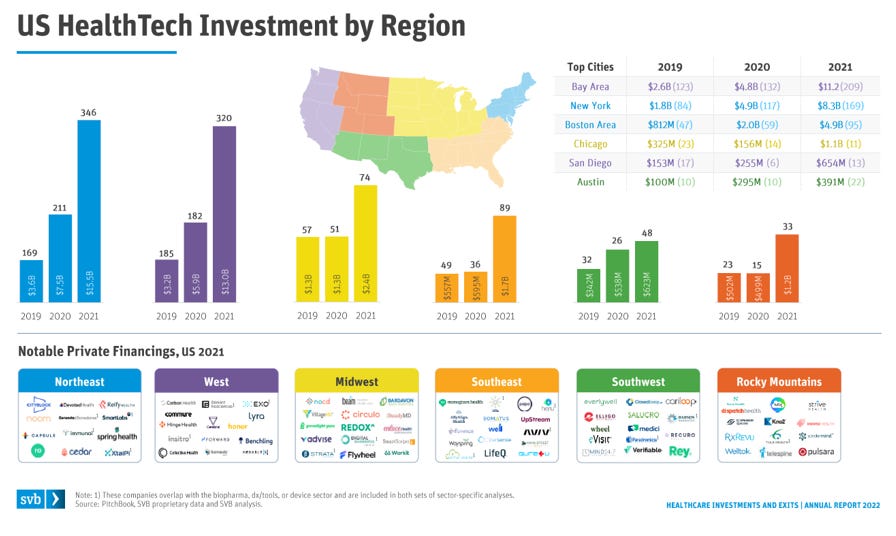

For years, Boston was considered the center of the life science industry. Later, the tech activity in Silicon Valley gradually poured into healthcare and made the area another well-known healthtech hub. As a derivative, the number of companies and available capital were far bigger than any other region in the U.S.

However, in recent years NY has been starting to emerge as another healthtech and digital health hub, with rising numbers of companies being established there and an influx of available capital for digital health companies.

Source: NYCHBL, NY Healthcare Innovation report 2022

Eventually in 2019, NY surpassed Boston in these two parameters (# of companies and $ invested), while being very close to the Bay area as the clear ‘market leader’.

Source: Startup health

What can explain NY’s dramatic jump? One may claim the reasons are all hinged around the resources needed for the R&D process of software-based medical products, which can be found in rather small geographic locations.

Diverse human capital – in NY there is an abundance of talent due to the large number of top tier universities (Cornell, NYU, Columbia) and activity of large tech companies (Google, Microsoft, Salesforce, media companies, etc.). As opposed to medical device or biotech companies, in many cases for digital health companies the required team is quite heterogenic – not only engineers or people with life sciences background but also data scientists, design experts, customer engagement professionals and so on. Therefore, being able to tap into a large and diverse talent pool is crucial.

Leading medical centers, suitable for serving as design partners or pilot sites – in NY there are 3 of the top 15 hospitals in the U.S. (Presbyterian, NYU Langone, Mount Sinai), together with a large number of hospitals and clinics concentrated in a relatively small location. This wealth in clinical sites unlocks more opportunities for companies to test drive (and launch) their products.

Heterogenic population that can serve as a sample study group to assess effectives of new products. Access to study subjects coming from wide range of social, demographic and cultural background in short distance makes clinical study execution much easier and less expensive, with the potential of achieving much more robust conclusions per the diverse study population (i.e. can be generalizable to other locations).

Wide range of acceleration programs provided by the city of NY. For example LifeSciNYC, an initiative launched in 2016 by the NYC economic development corporation, a $500M program aimed at creating 16,000 new healthcare jobs by 2026 and NY Digital Health Innovation Lab, which ran 5 acceleration programs between 2012 and 2017 leading to 27 new companies raising more than $250M in follow on investments.

Meaningful (quantity and quality) access to capital. Most of the leading healthcare investment firms have a local footprint in NYC on top of large amounts of accessible non-dilutive funding (NY was ranked 2nd in the U.S. for NIH grants, with $2.1 Billion, and also ~$500M raised from donations).

While pondering these elements, it seems like there are at least some similarities to the situation in Israel.

A large pool of top notch human capital has been generated as a result of high-quality education and lots of hands-on training at a relatively young age in the tech units of the Israeli army. Per Israel’s small geographic area, there is a concentration of large hospitals in a very small location. Just in the Tel Aviv Metropolitan area there are three tertiary, >1000 beds hospitals (Sheba, TAMSC, Belinson). The demographics of Israel also include a very heterogenic population. On the capital side, Israel has been at the forefront of governmental support programs and national expenditures on research and development, in particular with a $300M program dedicated to digital health that was launched in 2018. Finally, Israel is a consecutive world leader in total value of venture capital investments per capita and in 2021, on a per capita basis, capital flows into Israel were a whopping 28 times more than those in the U.S.

As with New York, these characteristics can serve as a steppingstone for many high-quality digital health companies. According to StartUp Nation Central, 113 digital health companies raised capital in 2021 (which is about 1/7 of the US numbers, where the US population is x30 in size).

For sure, there is still much more work needed to materialize Israel’s potential.

The more we will be able to attract additional talented individuals into this field (programs like SpearHeatlh are a great example), build more cross industries collaborations (such as exploiting Israel’s experience in cyber security and fintech) and build more bridges to the U.S. and other main markets (shout out to Anthem’s R&D site running in Israel over the last couple of years), the more promise we’ll see realized from the Israeli digital health industry.

As always big thanks to Sam Cronin from our team for his help!

Nadav

Let us know what you think!