Healthcare’s AI Gold Rush: Why the Real Moat isn’t Tech

Are we seeing another bubble? And if so, how to survive it?

There’s a tension in the air in early-stage digital health investing right now.

On one hand, we’re at the most exciting frontier in tech since the emergence of cloud computing. AI has opened the door to an unprecedented wave of innovation: new clinical tools, diagnostics, revenue cycle automations, and even full-on care delivery platforms re-architected from first principles.

On the other hand?

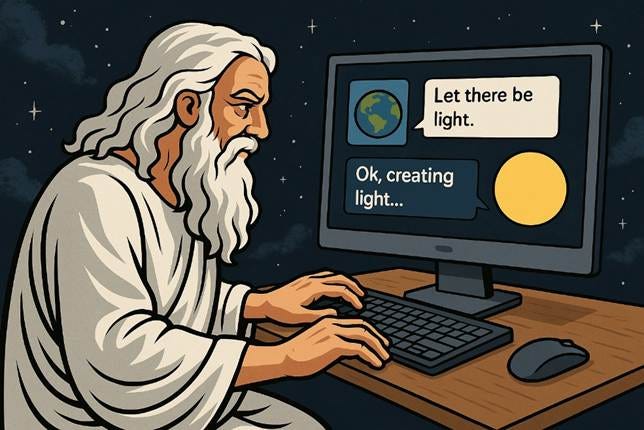

It’s never been easier to build.

Which also means: it’s never been harder to stand out.

That’s the AI era’s paradox: the easier it gets to build, the harder it gets to grow.

So, where to focus?

Someone forwarded this to you and you want to make sure you won’t miss the next piece?

The opportunity

Healthcare has long been a slow adopter of new technologies. But something’s changed.

We’re now seeing unprecedented openness to new products. This stems from two significant headwinds that, for the first time, can be effectively addressed by technology.

1. Financial pressures are becoming unbearable as both providers and managed care entities are operating with razor-thin margins. More than a third of US hospitals are bleeding money (Advisory Board, May 25), and in just one month, both United and Centene lost almost half their market share.

2. Over 50% of U.S. clinical staff are burned out. EHRs have only exacerbated the issue, and half of this burnout is proven to be tied to a poor user experience with computers.

And AI can actually help here – creating a better user experience for clinicians, reducing the level of non-clinical tasks (for example, scribing), and reducing dependencies (and expenditures) on non-clinical staff (for example, RCM), which all tie to improved financial outcomes.

Vibe Coding vs. products that somebody will pay for

However, many builders are taking note of this immense opportunity. Many are actually in the building phase. Talk to founders in the space, and you’ll hear a phrase tossed around with both pride and panic: “vibe coding.”

It’s a nod to a new world of rapidly prototyped AI tools - cobbling together APIs and foundation models over a weekend, showing off demos that feel real (even if the backend is half duct taped). Building an initial product is becoming increasingly easier, and therefore, in many fields, we are seeing a surge in companies emerging at an unprecedented pace.

At the very least, it increases the level of noise when selling to customers, but when these mature, there is a danger of commoditization. This leads to a key question when considering a new company: What can truly differentiate it? What can be done to maintain it?

I’d suggest that the answer should come from the buyers, not from tech.

The 80/20 role, upside down

In complex industries like healthcare, having 80% of a product isn’t good enough. Features such as IT integration, frictionless compatibility with clinical workflows, ease of use, and immediate ROI will make the difference between a great tech solution and one that people buy.

A few parameters that can help better understand if you are in the right direction:

Activation Speed – how long from contract to go-live?

Engagement Ease and Depth – Is the product embedded into real workflows? What is the NPS / feedback from users? How much time does it take for a new user to be fully ramped up?

Sales Cycle Clarity – Is there a specific buyer (i.e., specific role within a particular type of organization), and how fast do they close?

Somebody wants it, but is it scalable?

Let’s say there is customer love and a willingness to buy. Now there is another question: Can you support that demand?

In the ZIRP (zero interest rate policy) area, capital was relatively inexpensive, and growing at all costs was the primary goal. Today, it is no longer the case. This is a significant issue when building AI-based products, as one of the most overlooked risks is the compute cost. It is very similar to cloud costs. You start with free credits… but as you grow, costs scale. Dramatically.

Just like early Cloud-era startups, AI companies are now realizing that their infrastructure costs don’t scale linearly. And if you’re not careful, inference and fine-tuning can break your gross margins.

Source, GPTforwork cost calculator

There are emerging ways to address this. For example, reducing the number of tokens a product uses (i.e., the number of LLM pings performed) and combining off-the-shelf models with self-developed ones are examples.

Separately, AI also presents an opportunity to reduce internal operational expenditures for emerging companies, which can sometimes offset some of the impact on gross margins.

Some ideas:

Creation of marketing materials

Review and response to compliance requests

Automated customer support functions

Reduced G&A overhead

Closing thoughts

Ultimately, the winners of this AI-driven wave in healthcare won’t be defined by their model architecture or tech stack, but by their ability to translate fast-moving innovation into durable, scalable value. That means building with the end user in mind, obsessing over ROI, and designing products that solve not just for performance, but for trust, usability, and integration.

In a market flooded with prototypes and pitch decks, the actual moat won’t be found in the codebase or fancy team resumes. It’ll be in how deeply the product understands and fits into the messy, margin-thin, deeply human system that is healthcare.

Thank you for reading "Differential Diagnosis"!

If you are enjoying it, maybe somebody else can also?

Please spread the word with others!

Really good article!