Changing Buyer Landscape

Or - Why now it might be a good time to stress test your GTM hypothesis?

As people are starting to finalize their plans for Christmas, we are approaching the time of the year when you can’t turn your head without hitting another end-of-year summary piece or projections for the coming one. So instead of keeping you waiting, here is an opportunity for some bird’s-eye thoughts on what seems to be a major shift happening for some time and accelerating in 2022, the change in types and nature of customers digital health companies are trying to sell to or hope to get acquired by. And no, this will not include a single word on being “the Shopify of…” healthcare and selling to virtual first providers.

The driver for this piece isn’t the calendar (approaching year’s end) as much as a crop of recent announcements either on significant, perhaps even exceptional acquisitions (Amazon/One Medical, CVS/Signify, Walgreens/Carecentrix, and the recently announced Village MD (Walgreens) / Summit Health), partnerships (United/Walmart) and financial challenges that seem like are here to stay for a while (hospitals…)

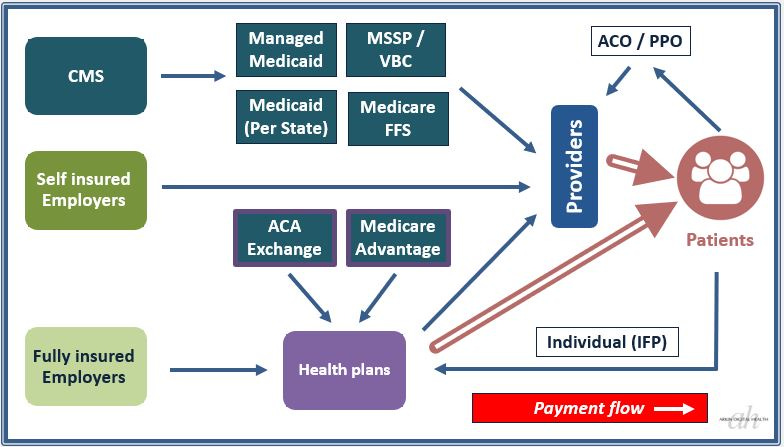

A good kicker might be the following chart which is a VERY simplistic attempt to illustrate how money flows in the healthcare industry:

The following pages will essentially review the manifestations of a struggle between these different entities presented here to have more of these arrows pointing at them (being paid) and reducing the ones extending from them to anyone else (keep all the revenues).

Hospitals and health systems (‘The providers who struggle to provide’)

In a short, this is perhaps one of the most challenging times hospitals and health systems have ever faced. That is a pretty bold statement so let’s try to unpack it.

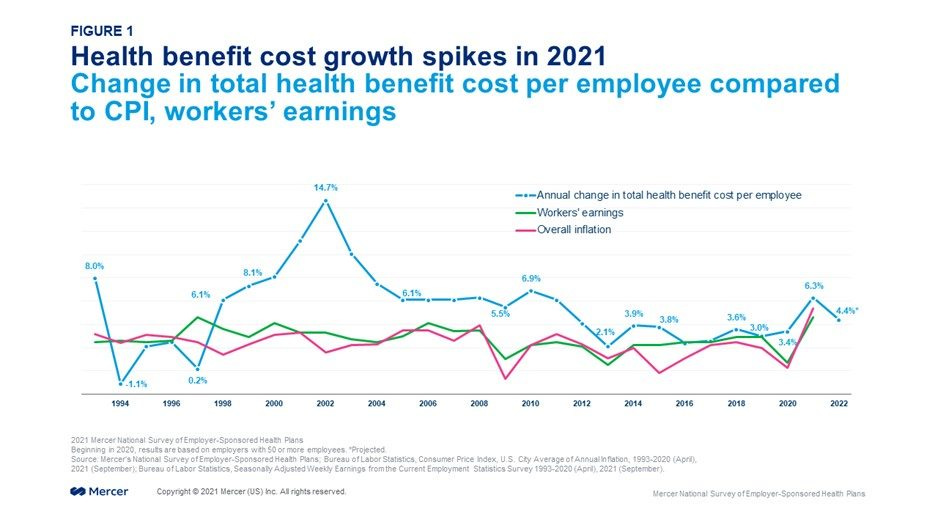

There are couple of general market head winds that are extremely painful for providers per their already slim margins and historical operational inefficiencies. Case rates (especially the more lucrative ones) are not going back to pre-covid levels, inflation pressures (more expensive… everything), and a growing staffing shortage combined with all-time high (63%!) of staff burnout and governmental COVID subsidies ending are all pushing providers margins into red areas for the foreseeable future. How severe is it? Health systems are actually laying off people despite their staffing shortages…

All of these are making the hospital C-suite laser focused on solutions that can objectively generate $$$ in 12 months or less.

For example this recent survey of ~300 provider organizations by Bain and KLAS, suggesting the biggest areas for investment are RCM, patient intake and cyber security. Also, interesting observation in this report about the influx of vendors which overwhelms providers:

“More than 50% of providers are struggling with the flood of offerings in the market: They cite concerns about missing high-impact new solutions or simply feeling overwhelmed by the number of offerings to evaluate. In fact, a quarter of all providers claim that their existing tech stacks keep them too busy to stay current on new offerings in the market…”

Potential takeaways for companies selling to providers:

Make sure you have objective evidence (data, case studies, etc.) you can either generate revenues or reduce expenditures for your providers customers. Any type of “improving patient experience" type of argument is currently not compelling enough (or even shall we say – irrelevant).

Make sure you can objectively convince that the former will happen within 12 months or less.

If you are able to meet these two requirements, I would argue that in this current environment your sales cycle might actually be accelerated (based on real examples we are seeing with portfolio). If not, don’t be surprised if customers aren’t returning your mails and phone calls.

Last point might be the growing tendency of providers to rely on existing vendors for new solutions:

“…Providers are increasingly streamlining bloated tech stacks and looking to their electronic medical records (EMR) providers and other existing vendors for new solutions before evaluating new vendor offerings… Many plan to increasingly look to existing vendors with proven solutions before considering offerings from new vendors (around 72% of providers)…”

Two relevant points might be (1) pursuing the right channel partnerships with these vendors (for example this work our portfolio company Validic is doing with Cerner) and (2) could be important to think where Epic for example might expend next (clinical trial recruitment?) to either avoid it or push harder there to be a potential acquisition target.

Health plans (‘rulers of the premium dollar’)

The flip side of the negative impact COVID created for providers, is its positive affect on payers. As volumes of reimbursable healthcare activities were reduced during the last two years and still not getting back to pre-COVID level, payers need to pay less, while the cost of having a health plan was actually increased.

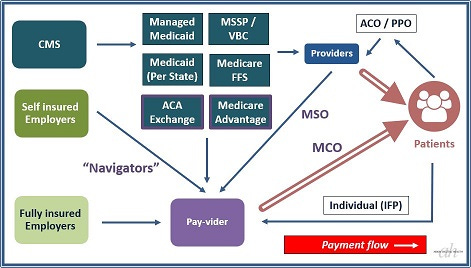

But on top of that, 2022 marks yet another year of continued vertical integration– in different phrasing: the arms race to own more premium dollars, with the notion of payers becoming pay-vider (i.e. payers and providers) with growing capabilities in the care delivery (MCOs, with clinics and physician groups becoming one of the most desirable targets for acquisition) and care enablement/supporting services (MSOs, worth to mention Optum / Change merger completed this quarter). Anthem completing it’s rebranding as Elevance and its care delivery arm as Carelon might be a great example also worth highlighting in that perspective on both points.

The incentives might be better illustrated by an alteration of the money flow chart presented above.

Potential takeaways for companies selling to payers:

Doing proper research to better understand what these organizations currently offer (on the health plans side/care delivery side/care enablement-services side) could be highly valuable. What do they currently have (in-house or via partnership) and where do they aspire to be? For example, see this comparison between United, CVS-Aetna and Amazon.

Source: Lumeris

Perhaps stating the obvious, but following on the previous point, it is super important to understand what isn’t of interest to avoid wasting time and resources. For example (and as also illustrated in the figure above), United seems to have a very clear strategy to avoid any type of in-patient care (not be confused with ASCs!).

Keep in mind that most of the national payers are public companies (United, CVS-Aetna, Elevance, Humana…). In the choppy public market we are currently in, this is especially important (for example, to some extent desire to secure the type of deals that might help with public market sentiment).

Retailers (‘leveraging multiple physical locations for care delivery… and clinical trials recruitment?’)

The vertical integration play is well relevant for the large retailers as well.

CVS-Aetna, now from the retail side, has been repeatedly announcing its plans for primary and urgent care with ~1500 MinuteClinics, combined with the recent addition of home care based on the Signify acquisition.

Walgreens has chosen first to add more dedicated physical footprint by working with VillageMD and now adding more diverse primary and urgent (and even specialty) care with Summit Health and post-acute care with CareCentrix.

Walmart has actually recently chosen a different path, announcing a 10-year strategic collaboration with United Health Group, launching a co-branded Medicare Advantage plan in Georgia, leveraging Optum (Insight) for VBC and finally having the virtual care offering to be included in United Health Care Choice Plus Network.

Keeping in mind these large retailers have more physical touch points with people than any other organization in healthcare, the newly announced clinical trial recruitment plays (Walmart and Walgreens) actually look like something very reasonable to pursue.

Potential takeaways for companies selling (or thinking about selling) to retailers:

Although they all in the same category, these organizations are VERY different when it comes to healthcare activities and strategy. From all, Walmart seems much more to (still) be in the experimentation phase, and as such there are pros and cons when you consider them as potential partner or customer.

As there are dedicated business lines within these organizations that are governing the healthcare activity (CVS Health, Walmart Health…), and are being measured to some extent as the “new kids in the family”, especially in an inflationary time, the distance from bold aspirations to reducing expenses in non-core businesses in pretty short. Having a well-defined, perhaps even limited but concrete, value proposition that does not require significant up-front investment can be an important kicker (and remember that human hours is perhaps one of the biggest investments an organization can make, in particular in current job market). This point is by all means relevant to other types of customers.

Large Tech (‘We’ll keep on trying until we figure it out… or until our share price won’t allow?”)

Following Amazon’s acquisition of One Medical on top of a lot of additional activity (acquisitions, spin offs, pivots…) by large tech in the last 12-24 months, I’ve tried to summarize the action and shared in extent why it seems like large tech are starting to figure out where they should focus in healthcare and where not, and in what also seems like “lets divide the world between us”.

We have also recently interviewed Dr. Amy Abernethy, President, Clinical Studies Platforms at Verily, in our podcast mini-series “Digital Health Business” to learn more about the company’s activity in the space (and the importance of generating clinical evidence).

Just as self-reflection, not so long after the announcement of AMZN’s One Medical acquisition and the wave of analysis published thereafter (including the one above by yours truly), the news about Amazon Care being terminated came out and yet again emphasized there are still more unknown than knowns here.

Potential takeaways for companies selling (or thinking about selling) to large tech:

Per the notion these companies are still experimenting on many fronts in healthcare, one way to have more educated guesses where they might double down is thinking about their core competencies. In this market and in general, eventually focusing on what has been working / you are positively known for makes a ton of sense. Couple of examples - Amazon with superior customer experience, especially around on-line shopping (pharmacy?), Google with data indexing and analytics (clinical research and real world evidence?), Microsoft in B2B enterprise land and expend (cloud based operations?). More color on that in the aforementioned blog piece.

The comment above (retailers) re: the short gap from bold aspirations to reducing expenses in non-core businesses, seems to become true also for large tech; FYI 11,000 people being laid off from Meta and 10,000 from Amazon. This might also help to reveal how core the healthcare focus is for large tech.

However, a unique characteristic of these companies is the huge piles of dry powder they possess (e.g. Meta’s $40 Billion…); combined with the lower valuations environment we are in, this can create an incentive to shorten their development plans by acquiring market ready assets. Following on the Meta example, I wouldn’t be surprised if we see Meta acquiring a VR healthcare focused company in the coming months.

Pharma (‘say AI-drug discovery one more time’)

Last but not least, let’s talk about pharma. In the digital health ecosystem, pharma is mostly considered as a potential customer for enhanced drug discovery processes (AI driven/more data-based) and decentralized/more efficient clinical trials… The third bucket might be digital therapeutics, though with its own fair amount of challenges, as I previously addressed separately, which might also be reflected in the poor performance of public companies in this category (Pear, Akili).

I actually think there is much more about pharma that is currently not being largely pursued by digital health companies. These companies have pretty resilient budgets (for example pharma S&M market on its own is a $10Bn market). So on that frontier, and perhaps ending this piece with a call for action, we would love to see more companies targeting pharma in any place which is not drug discovery or clinical trials (which in our perspective are super crowded) – especially around SG&A. As a digital health investor with a substantial in-house pharma activity (for almost half a century!), this is of particular interest for us, please reach out if you’re building or even just looking at this space

As always big thanks to Sam Cronin from our team for his help!

Nadav

Subscribe to easily receive new posts!

Let us know what you think!