Amy Abernathy - The Alphabet and Clinical Leader perspective

New episode in ‘Digital Health Business’ series by Arkin Digital Health.

In this episode we had Dr. Amy Abernethy with us.

Dr. Abernethy is a physician with a diverse career, starting as an oncologist thinking how to create novel treatments for her Melanoma patients, moving to Flatiron as chief medical officer until its acquisition by Roche for almost $2Bn in 2018, then the FDA as the principal deputy commissioner, the 2nd in command in this important organization and now in Verily leading their clinical research business.

We talked about the importance of the clinical role within digital health companies, especially as we hear growing demand for clinical evidence and how this function varies between different types of companies. We also discussed the changing regulatory landscape and how companies can be better prepared to cope with it.

During this episode we also touched the work of Alphabet and Verily in the healthcare industry. If you are interested in having more color on what large tech (Amazon, Microsoft, Alphabet, Apple) are doing in healthcare (and why it seemed like they are starting to figure it out), check out this piece.

You can listen to the interviews and follow the series via -

Also, if you are not already subscribed to this blog, you can use this link to easily receive new posts!'

Nadav: you have served in leading clinical roles within different organizations. Verily, FDA, Flatiron. How do you see the clinical role within the digital health business? How do you see the clinical team function ? Do some companies need that function earlier?

Amy: When I took my original CMO role at Flatiron, I must say it was pretty much an emerging concept at the time. There were obviously CMO in biopharma and in medical devices, but the idea of health tech companies having CMOs who were leaders at the company was not necessarily always the case. Over time I think it became apparent Healthtech companies need different types of CMO. Some digital health companies need a CMO that's largely a sales enabler. Talk to clinical professionals in a way that's credible and allows the company to get in and have a credible voice. Some companies need CMO's who are internal communicators, helps the product teams and engineering teams know what good looks like and make things clinically relevant. Sometimes the CMO is an external communicator. The role of that kind of CMO is perhaps as thought leadership or even the scientific leader. And then there's CMOs who are regulatory policy experts, or even CMO's who's a leader of leaders within the tech company. And as a founder thinking about what it is that you need the most in your company, it is going to be critical to making sure that your chief medical officer, just often a pretty expensive hire, is going to be maximally successful in your company.

All of those things - sales enablement, thought, leadership, internal leader, external communicator are very different skills. Therefore identifying the kind of physician who's going to have the 10X skills in the right space that you need for your company is really important. Don't assume that every physician has skills in all of these different areas.

Nadav: We hear more and more about the importance of generating clinical evidence. Not sure if this is a big surprise for those acquainted with the health care industry in general, but still for digital health it might a “new” thing. Some companies found ways to sell their product without pursuing this clinical evidence route. How do you see this trend affecting companies, affecting the CMO role within companies?

Amy: First of all, this might pertain especially digital health companies who have largely started off with founders largely coming from the consumer side of things (i.e. outside of healthcare) and now want to reapply their talents in the health care space. The idea of needing to develop clinical evidence, information that confirms that a product performs as expected, including both safety and effectiveness, becomes really sort of a new concept. And it's really important in digital health, especially as you realize that digital health products are largely regulated products, and therefore there are regulatory expectations of the quality, the reliability of the clinical evidence that's being generated. And that also means that there are fairly formalized approaches to how clinical evidence is generated, interpreted and also communicated.

It looks quite different than, for example, A-B testing or what you might find in the more consumer space. I anticipate that for digital health companies going forward, CMO, the clinical expert role, is also going to be very important in this clinical evidence generation landscape in helping the company understand what clinical evidence might be needed, how to communicate that evidence confidently, how to make sure it's clinically relevant. But I kind of go back to my prior point about medical professionals. Not every medical professional is trained or has technical skills and everything. So as a digital health company now needs to develop clinical evidence of safety and effectiveness of their product the CMO may or may not be the person being able to give advice of exactly how to do that. And you may need to look towards external expertise, other regulatory experts who might be inside your company, etc..

Nadav: Maybe with respect to generating evidence, it might be interesting to learn more what you are doing at Verily. I mean, I think you have done such an impressive progress in terms of the platform you are now offering. So perhaps hearing a bit more about your work at verily at this point would be good.

Amy: I think that the development of clinical evidence around medical products (drug, device or software) is going to be much more continuous than the cross sectional and formulaic clinical trials of the last several decades. If that's true, then we're going to need to build evidence generation solutions that allow for the continuous evaluation of medical products across their lifecycle. In order to do that, at Verily, we have really focused on several things. First of all, how do we build longitudinal data sets that are of adequate quality and depth and breadth to be able to evaluate medical products across their life cycles and meet the needs of regulators. And then how do we ultimately build clinical studies and evidence generation output from there. In 2022 and 2023, we are focused in Verily on building the component elements.

These include software in the clinical research workflow:

Electronic consenting and electronic patient reported outcome solutions.

Software for clinical trial sites (execution).

Solutions that allow for remote participant or patient monitoring, such as a watch that allows for time series data so that we can get digital biomarkers. For example, digital evidence of changes in movement or changes in sleep includes building longitudinal data sets that combine passively collected data like that.

Being able to combine it with EHR data with intentionally and prospectively collected data such as patient reported outcomes,

Solutions that really focus on patient and participant experience, meeting people where they are, recruiting people into clinical studies and engaging them across time.

The theory or the thesis is that by putting these core components together in a variety of different ways, we can actually now build the clinical trials and evidence generation solutions in the future. So, for example, randomized registry studies where a person might be in a registry about heart failure, and then now there's the goal of studying a new solution, whether that's a medical device or a digital therapeutic or a new medicine, and randomizing patients in that registry to either receiving that new treatment or standard usual standard of care.

Nadav: Going back to the regulatory angle. What are the major themes you're seeing coming out of the FDA that might affect digital health companies? How should companies deal with this to some extent, may I say a bit uncertainty about the regulatory environment?

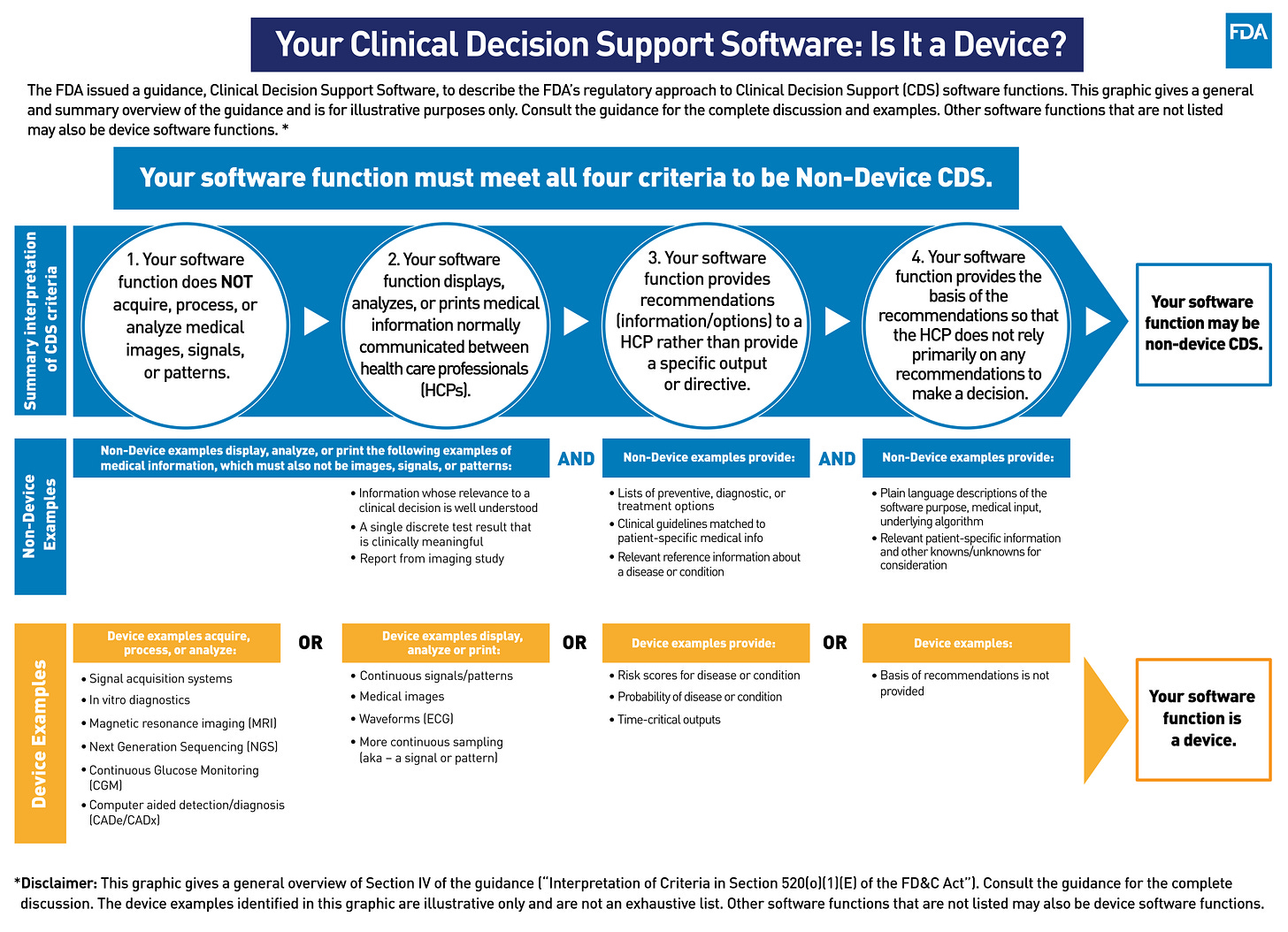

Amy: There has been a set of consistent definitions that I think classified and standardized internationally coming out around 2014 that helped to categorize potential products into risk categories that help us understand what level of evidence is going to be required in order to get this particular product to market. But the truth is, right now, we're still in this evolving landscape of exactly how to move from the traditional regulated landscape of medical devices to something that allows for the more flexible evaluation of digital, therapeutic or digital interventions that may be updating across time.

We have seen a plethora and a rapidly increasing number of AI and ML based medical devices coming in front of FDA, especially in the last two years, and also with some of the flexibilities made possible in the pandemic. And that's starting to teach us what regulations in the future might look like. And a lot of us were watching the pre certification program thinking that was going to point the way. Maybe it didn't help us as much as we wanted it to. But, I think that between pre cert and some of the work that came out of the FDA in early 2021, what we're seeing now is some consistent sort of directions.

First the notion of risk based classification, including both the health care situation or condition being treated as well as what the intention of the medical product is and whether or not there's going to be a medical professional adjudicating output before it's applied. This classification of risk is going to continue to be very important.

I think the second is that there's going to be tailored regulatory frameworks that continue to go along with that classification of risk. You've seen from FDA the expectation of good machine learning practice, GMP, and we're going to see that, I think, continue. We're also going to see continued focus and I think amplification of patient cantered approaches to incorporate transparency of the users.

Finally, there's going to need to be continuous evaluation of these medical products across their lifecycle, especially when algorithms are embedded. Hence Verily's focus on continuous evidence generation.

(Source: FDA)

And then there's going to be continuous evaluation of the risk of bias, both in the development of the products and also whether or not bias is perpetrated or persists because of the development of the products. And I think that's going to be sort of another big area of focus. So as I look towards the future, I think this space is changing. I think that as anybody who's working in this space, it is prudent to pay attention to new documents and observations coming out from FDA as well as other regulators around the world. And the other thing that I would do is remember to ask questions and to interact with regulators early and don't be afraid to contact, for example, the email address that FDA provides early and often in order to figure out the direction that you need to go.

Nadav: for a final question maybe something more general. How do you see this digital health market evolving? Is it really digital health? Maybe it's just health care.

Amy: I have a lot of different points of view on this. One thing is I've sort of been surprised at some of the digital health companies that have tried to develop products and even price them and think about them as if they are a replacement product for medicines. Digital health products are developed differently, have different regulatory pathways, are taken up differently by patients and their families. And leveraging a biopharma point of view, I think perhaps is a mental model that may seem like it makes sense, but I think has been hurting some of these digital health companies.

The other thing I would say is given there is going to be more of a focus on health care data from digital health companies, then it is also important that digital health companies realize that not all health care data is created equal. And so when you try and mash up, for example, time series data from a sensor together with EHR data, these data sets have very different properties and you have to understand the properties of the data sets and how they can be used together or not in order for this to work well.

As I watch this space, I'm curious to see how this story is going to start to play out, especially as we move from thinking of digital health products as a replacement product for medicines and rather in its own category, the system of underlying data, etc.

In that perspective, you can guess that one of the places that I see incredible opportunity is the development of digital health products that simultaneously contribute to the overall system of data. An example of this at Verily is that we are the medical device manufacturer and the group that invented the watch that just received FDA clearance with iRhythm. (NS: Verily’s watch recently received FDA clearance for Atrial Fibrillation detection via a collaboration with iRhythm)

And at the same time, that same device is our study watch for Verily’s clinical evidence generation platform and the ability to leverage that same device, both as a medical grade product used commercially as well as now a research product has dual implication and then can become mutually reinforcing.

I think that the pitfalls have sort of been a thread we've talked about over our time together. And that's that not paying attention to the data that you're going to need for evaluation of your product as well as how do you evaluate your product efficiently, both in its beginning stages and across time are going to be really important because if you can build that into your product evaluation across time, it's an opportunity, not a pitfall. But most companies that I observe have not been thinking about that in a clear way…

If you are enjoying this blog, it would be really helpful if you can share it with relevant people.

As always, would love to have your thoughts and feedback!

Thanks,

Nadav